| Group | Dummy Variable 1 (Contrast 1) | Dummy Variable 2 (Contrast 2 ) | Product (Contrast 1 × Contrast 2) |

|---|---|---|---|

| Control | -2 | 0 | 0 |

| 15 minutes | 1 | -1 | -1 |

| 30 minutes | 1 | 1 | 1 |

| Total | 0 | 0 | 0 |

Oliver Twisted

Oliver, like the more famous fictional London urchin, asks ‘Please, Sir, can I have some more?’ Unlike Master Twist though, Master Twisted always wants more statistics information. Who wouldn’t? Let us not be the ones to disappoint a young, dirty, slightly smelly boy who dines on gruel. When Oliver appears in Discovering Statistics Using IBM SPSS Statistics (6th edition), it’s to tell you that there is some awesome extra statistics or SPSS information on a webpage. Congratulations, you have found that webpage and now you may feast until overflowing with statistical gruel. (Seriously, please read it because it took so long to write that when I started Charles Dickens was still alive.)

Chapter 1

No Oliver Twisted in this chapter.

Chapter 2

Please, Sir, can I have some more … power?

- GLIMMPSE: especially good for multilevel and longitudinal designs

- GPower: free all round software

- nQuery Adviser

- PASS (Power Analysis and Sample Size)

- Power and Precision

- pwr: package for R, see this useful chapter

Chapter 3

No Oliver Twisted in this chapter.

No solution required.

Chapter 4

No Oliver Twisted in this chapter.

Chapter 5

Please, Sir, can I have some more … dimensions?

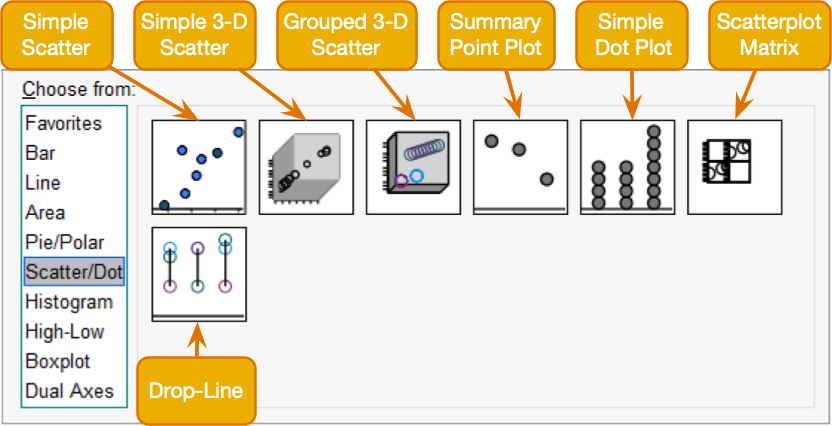

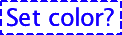

We’re going to extend the example from the book chapter to look at 3-D plots so load the data exam_anxiety.sav. Select Graphs > Chart Builder … and double-click on the simple 3-D scatter icon (Figure 1).

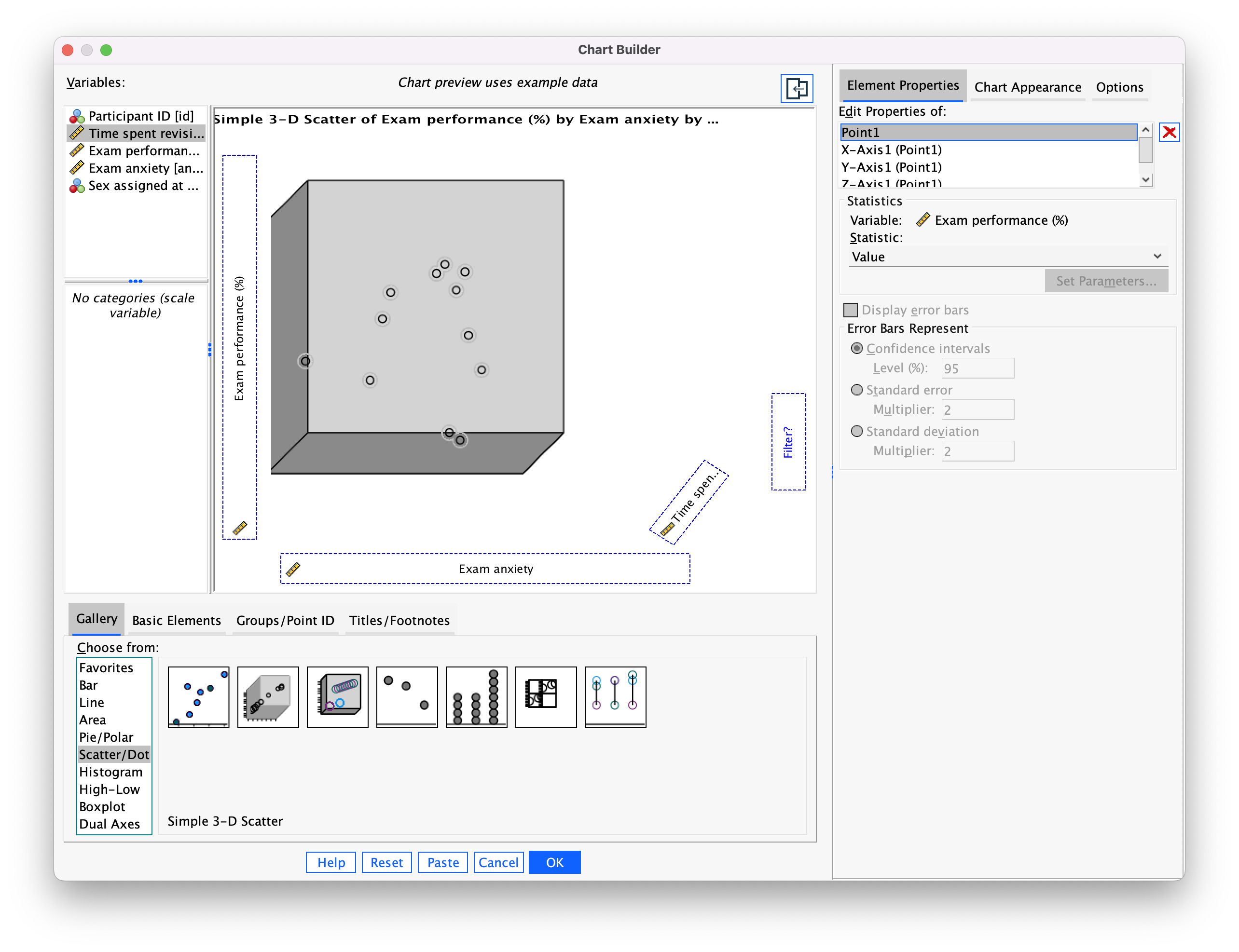

The plot preview on the canvas (Figure 2) differs from ones that we have seen in the book in that there is a third axis and a new drop zone  . It doesn’t take a genius to work out that we simply repeat what we have done for other scatterplots by dragging another continuous variable into this new drop zone. So, drag

. It doesn’t take a genius to work out that we simply repeat what we have done for other scatterplots by dragging another continuous variable into this new drop zone. So, drag exam_grade from the variable list into  , drag

, drag anxiety into  , and drag

, and drag revise in the variable list and drag it into  . Click

. Click  to produce the plot.

to produce the plot.

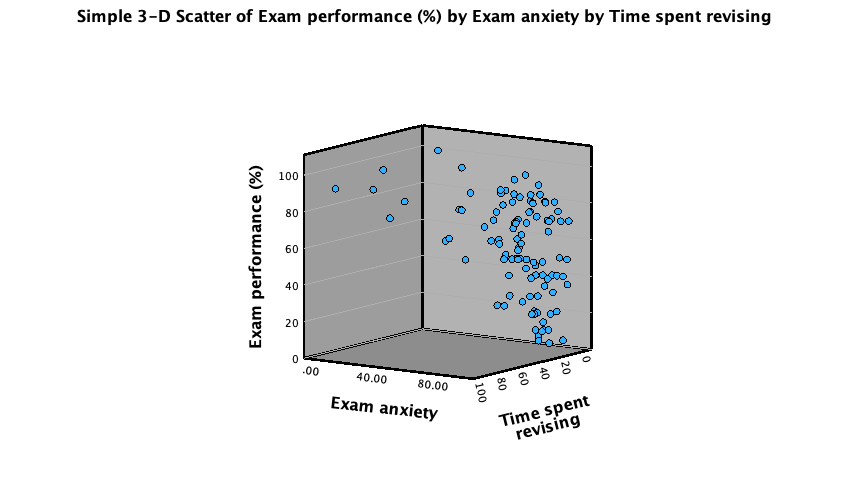

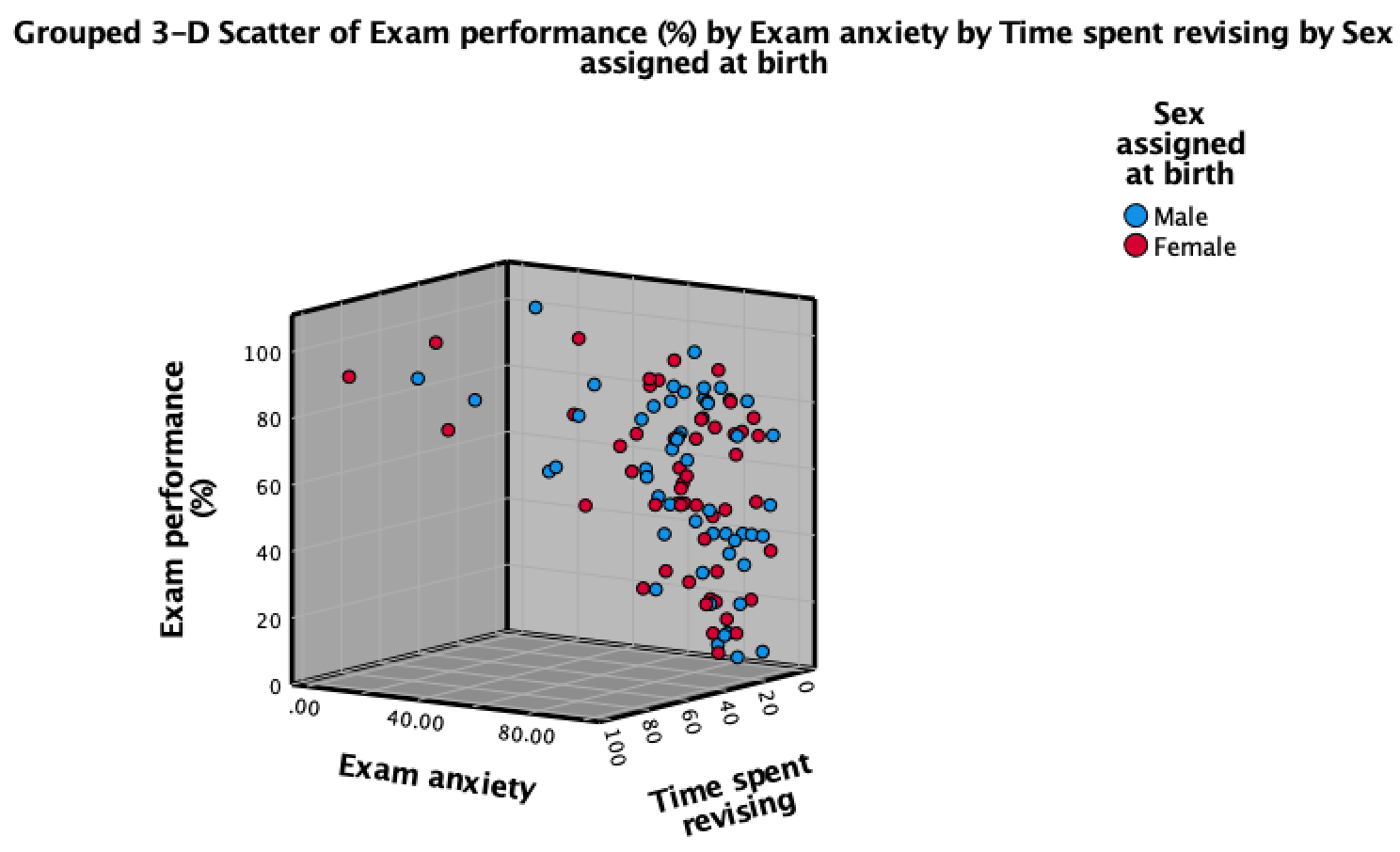

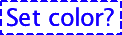

A 3-D scatterplot is great for displaying data concisely; however, as the resulting scatterplot shows (Figure 3), it can be quite difficult to interpret (can you really see what the relationship between exam revision and exam performance is?). As such, its usefulness in exploring data can be limited.

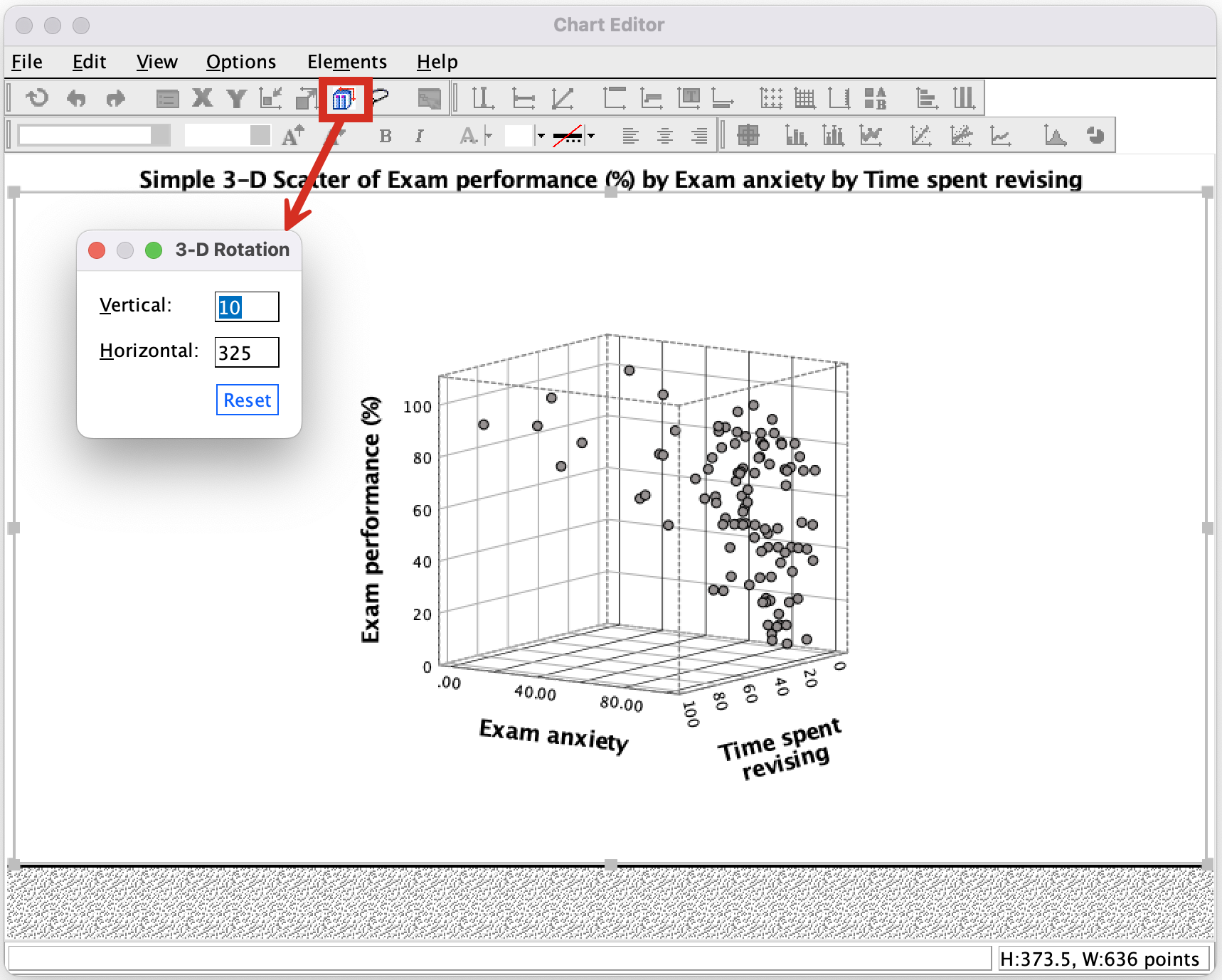

You can try to improve the interpretability by changing the angle of rotation of the plot (it sometimes helps, and sometimes doesn’t). To do this, double-click on the scatterplot in the SPSS Viewer to open it in the SPSS Chart Editor . Then click on the icon circled below to open the 3-D Rotation dialog box (Figure 4). You can change the values in this dialog box to achieve different views of data cloud. Have a play with the different values and see what happens; ultimately you’ll have to decide which angle best represents the relationship for when you want to put the plot on a 2-D piece of paper! If you end up in some horrid pickle by putting random numbers in the 3-D Rotation dialog box then click the Reset button to restore the original view.

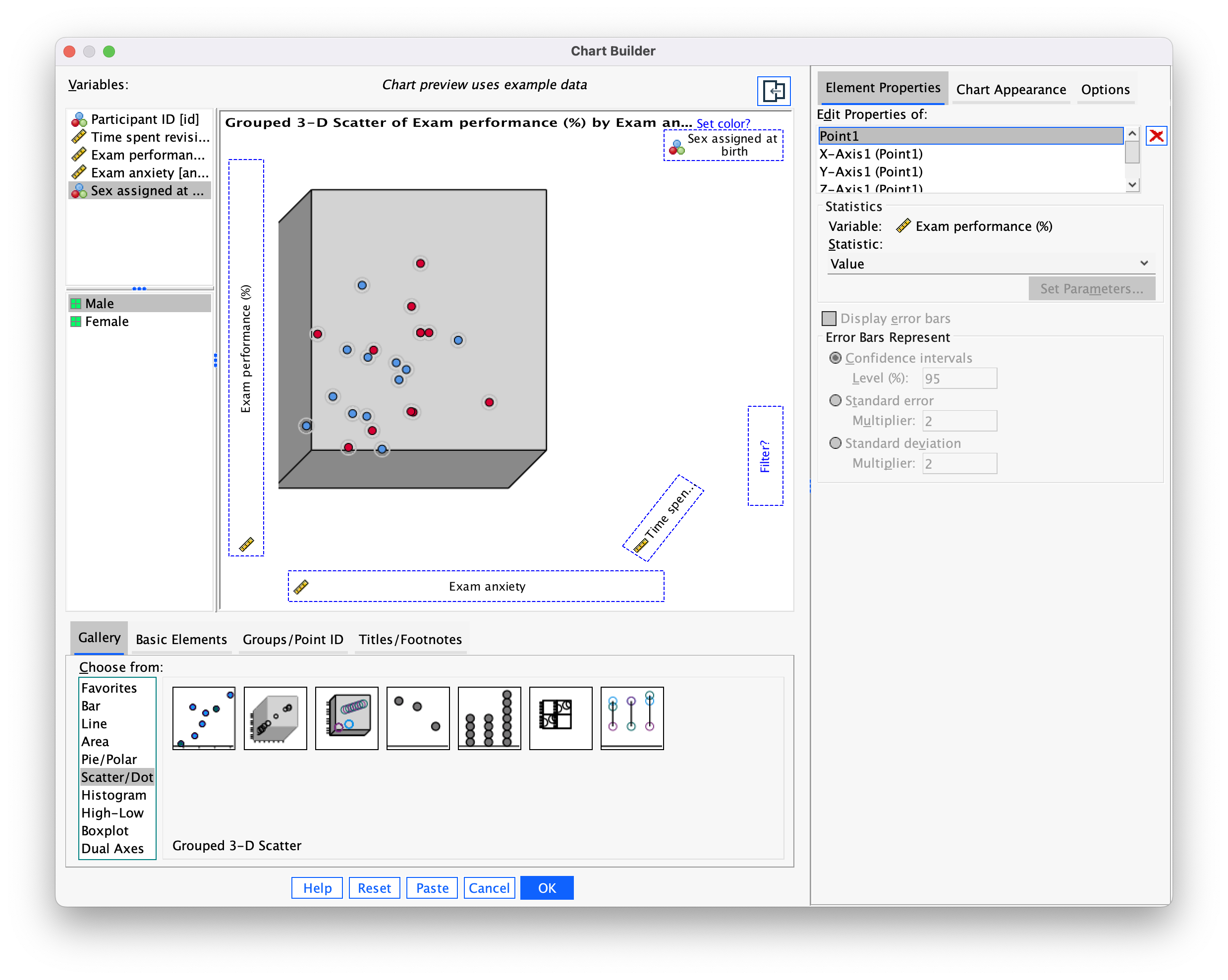

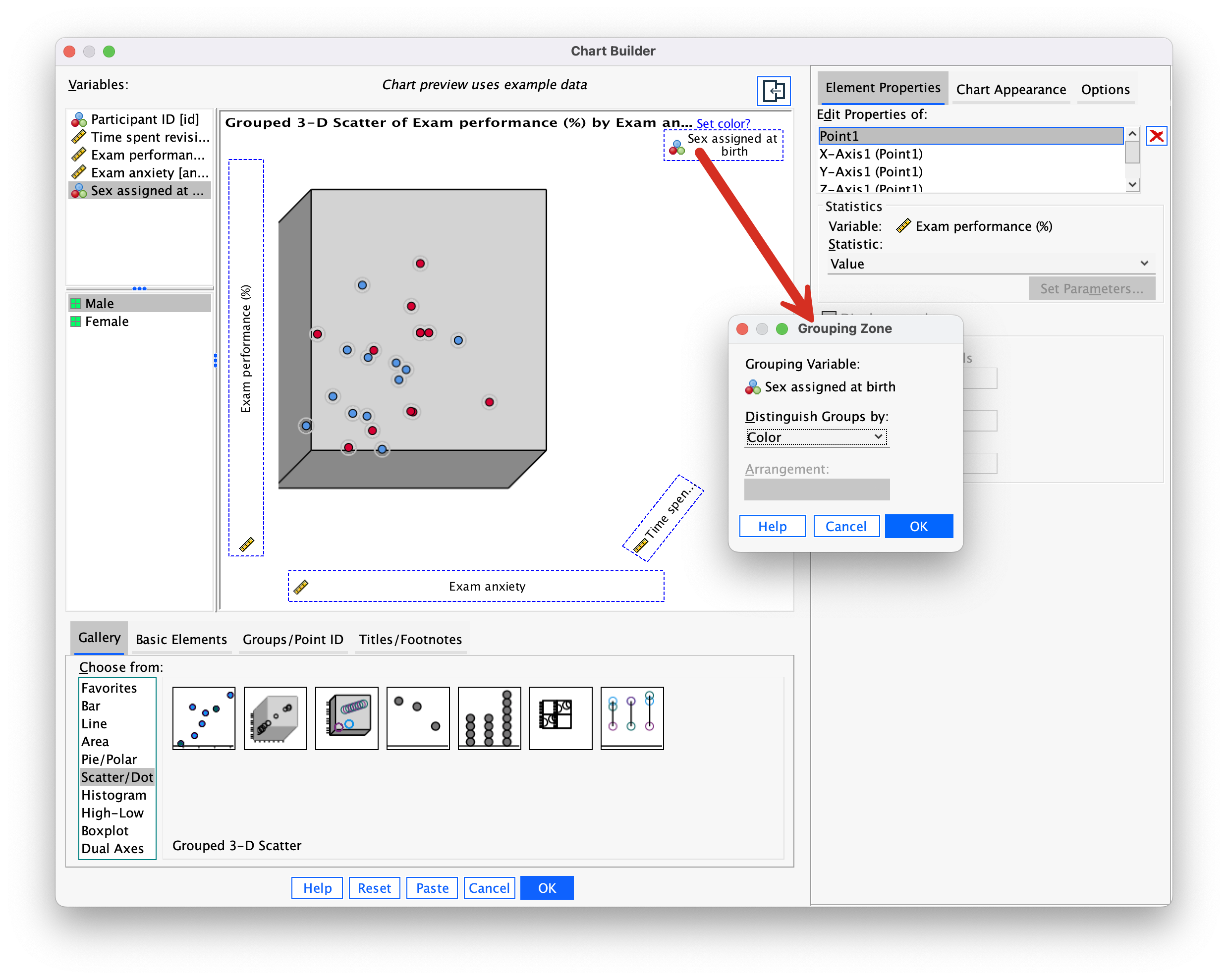

We can also split the data cloud into different groups using the grouped 3-D scatter icon in the Chart Builder. The plot preview on the canvas will look the same as for the simple 3-D scatterplot except that the  drop zone appears. Drag the categorical variable by which you want to split the data cloud (in this case

drop zone appears. Drag the categorical variable by which you want to split the data cloud (in this case sex) into this drop zone (Figure 5).

Click  to produce the plot in Figure 6.

to produce the plot in Figure 6.

Note that data points for males and females appear in different colours. We can also display different groups as different symbols (rather than different colours). To do this, go back to the Chart Builder and double-click the  drop zone. This opens a dialog box that has a drop-down list in which Color will be selected (Figure 8).

drop zone. This opens a dialog box that has a drop-down list in which Color will be selected (Figure 8).

Click on this Distinguish Groups by: drop down list and select Pattern instead of Color. Then click  to register this change. Back in the Chart Builder the

to register this change. Back in the Chart Builder the  drop zone will have been renamed Set pattern. Click

drop zone will have been renamed Set pattern. Click  to plot the plot, which should look something like Figure 8.

to plot the plot, which should look something like Figure 8.

Please, Sir, can I have some more … plots?

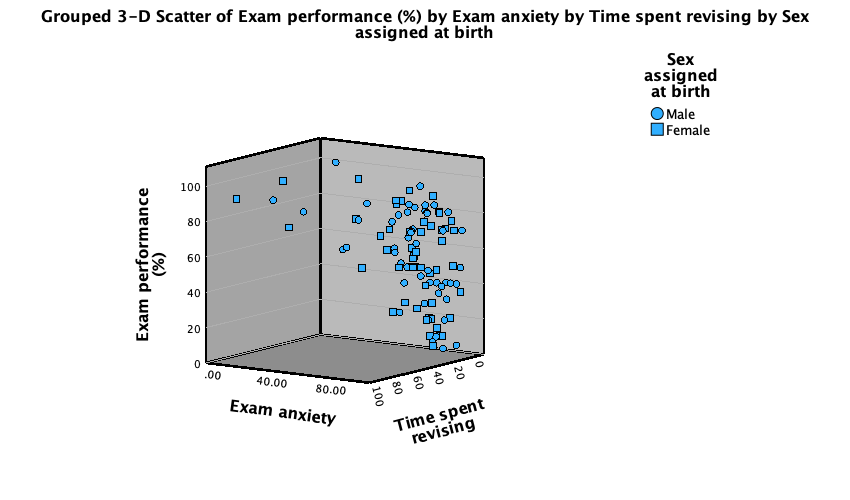

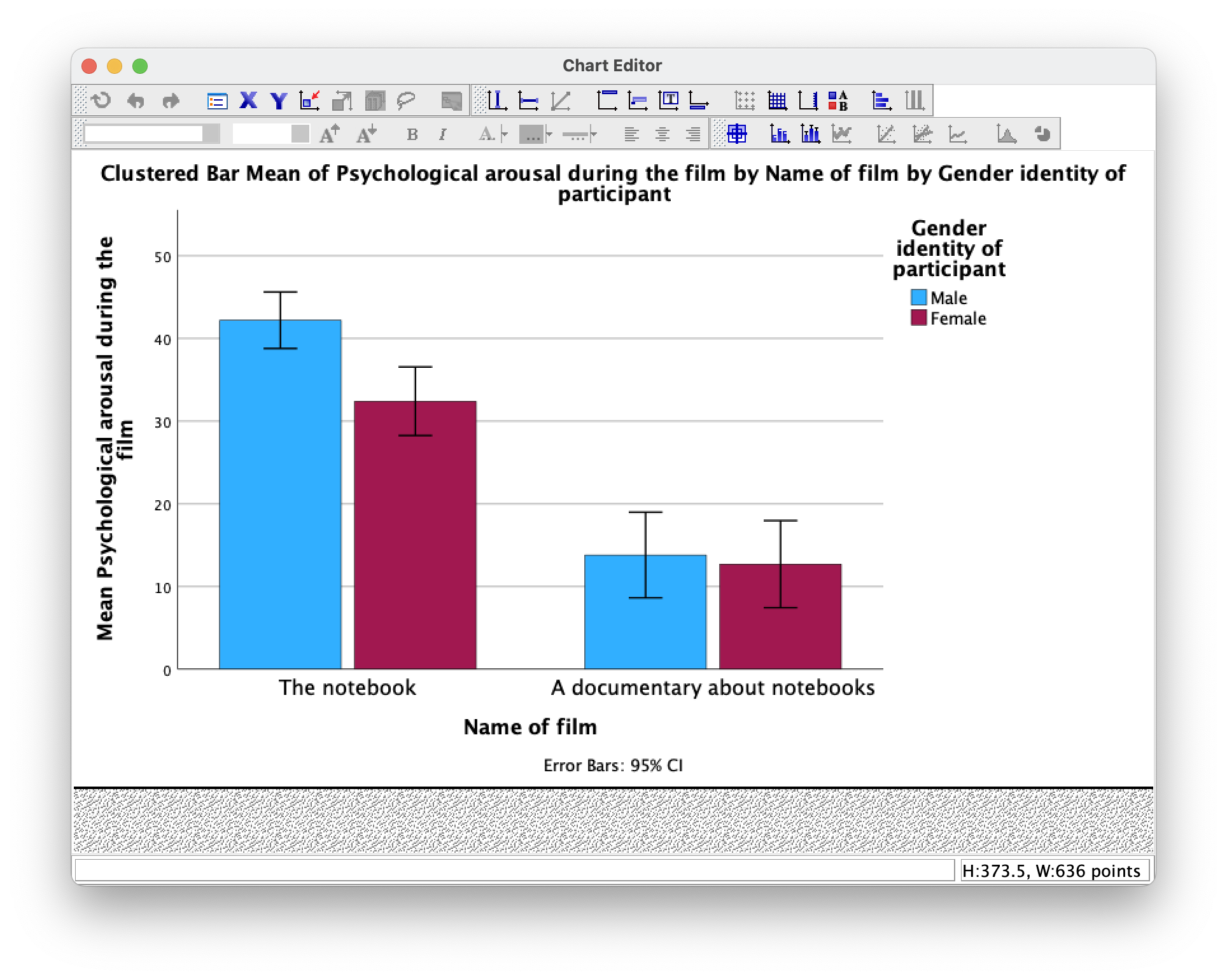

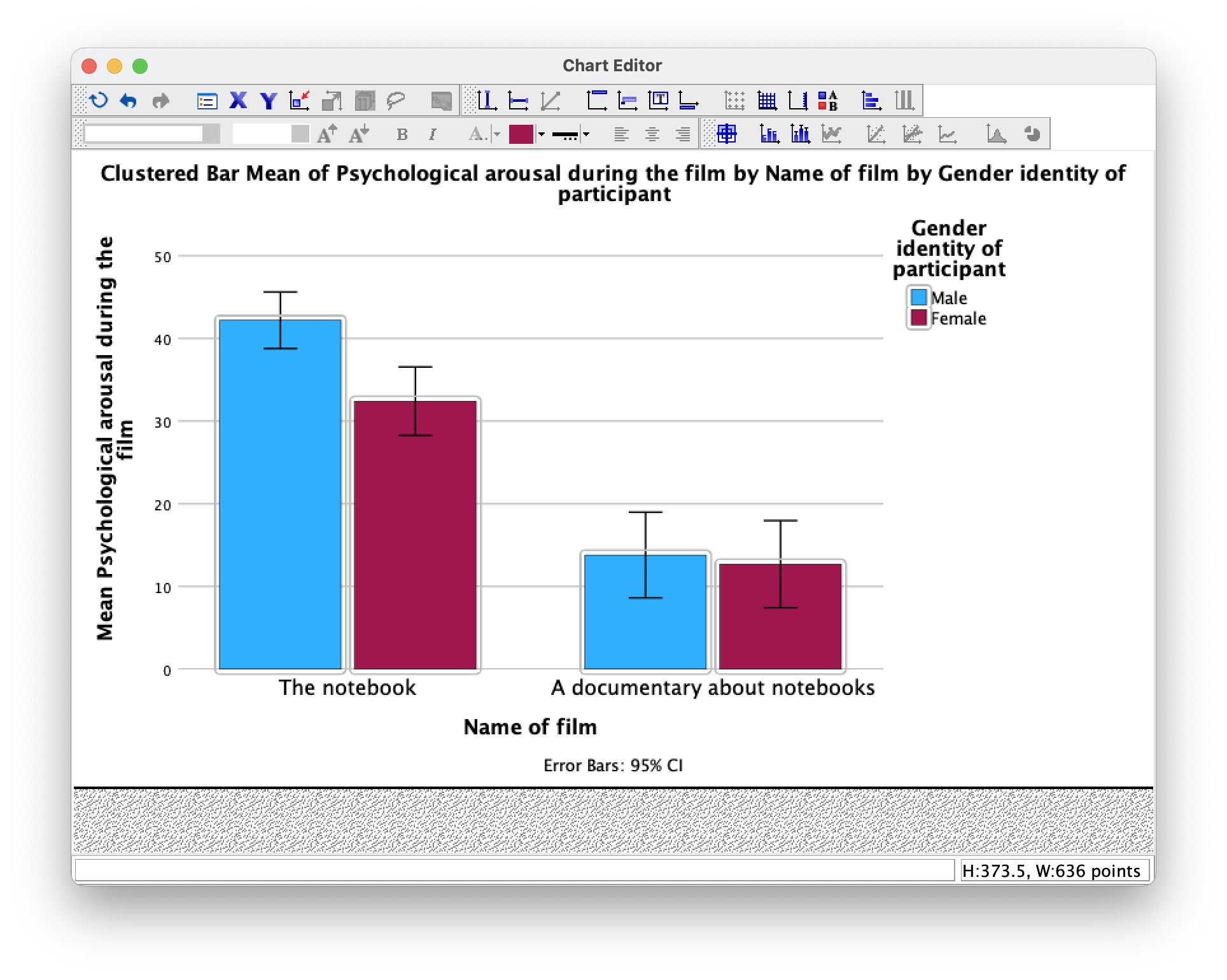

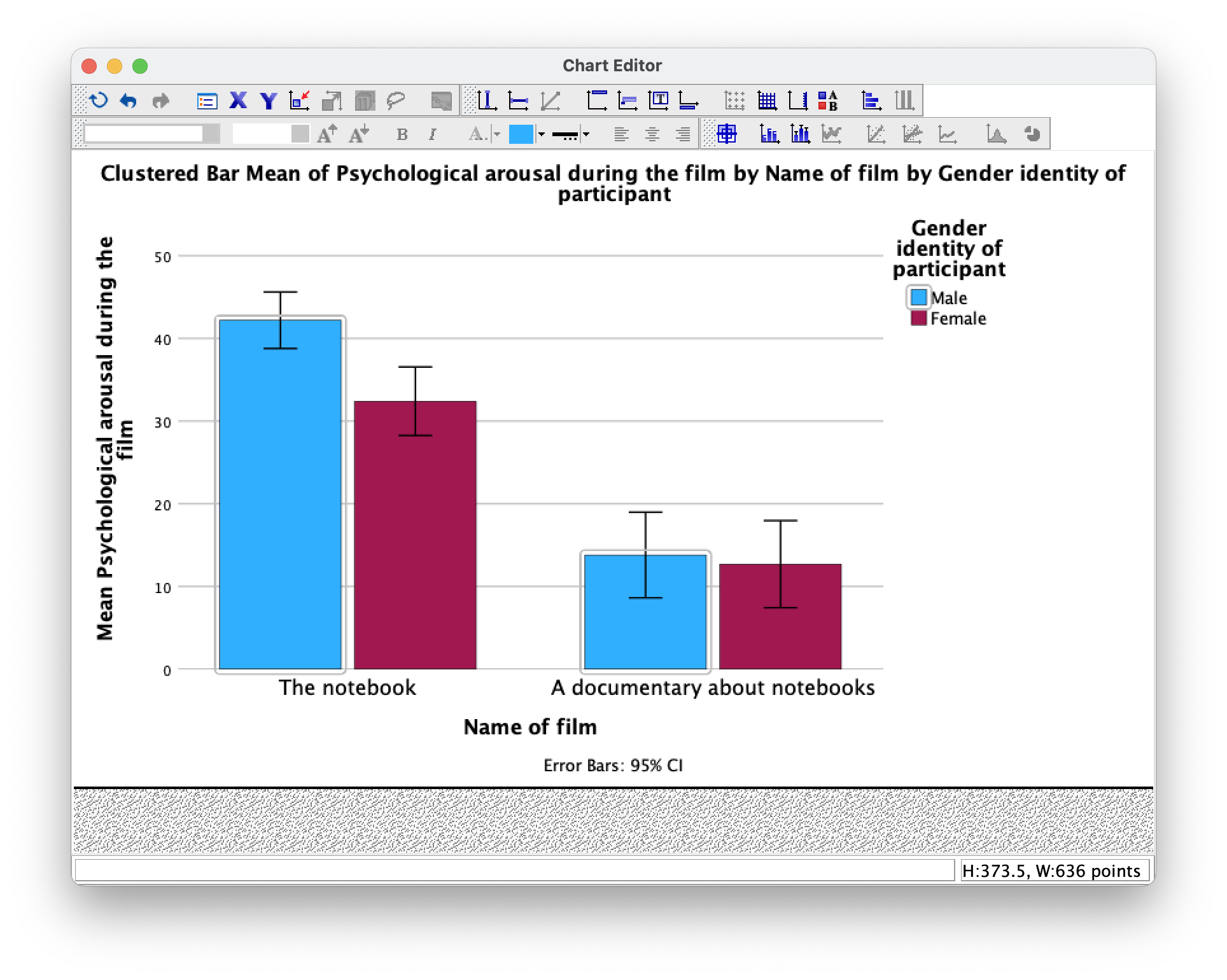

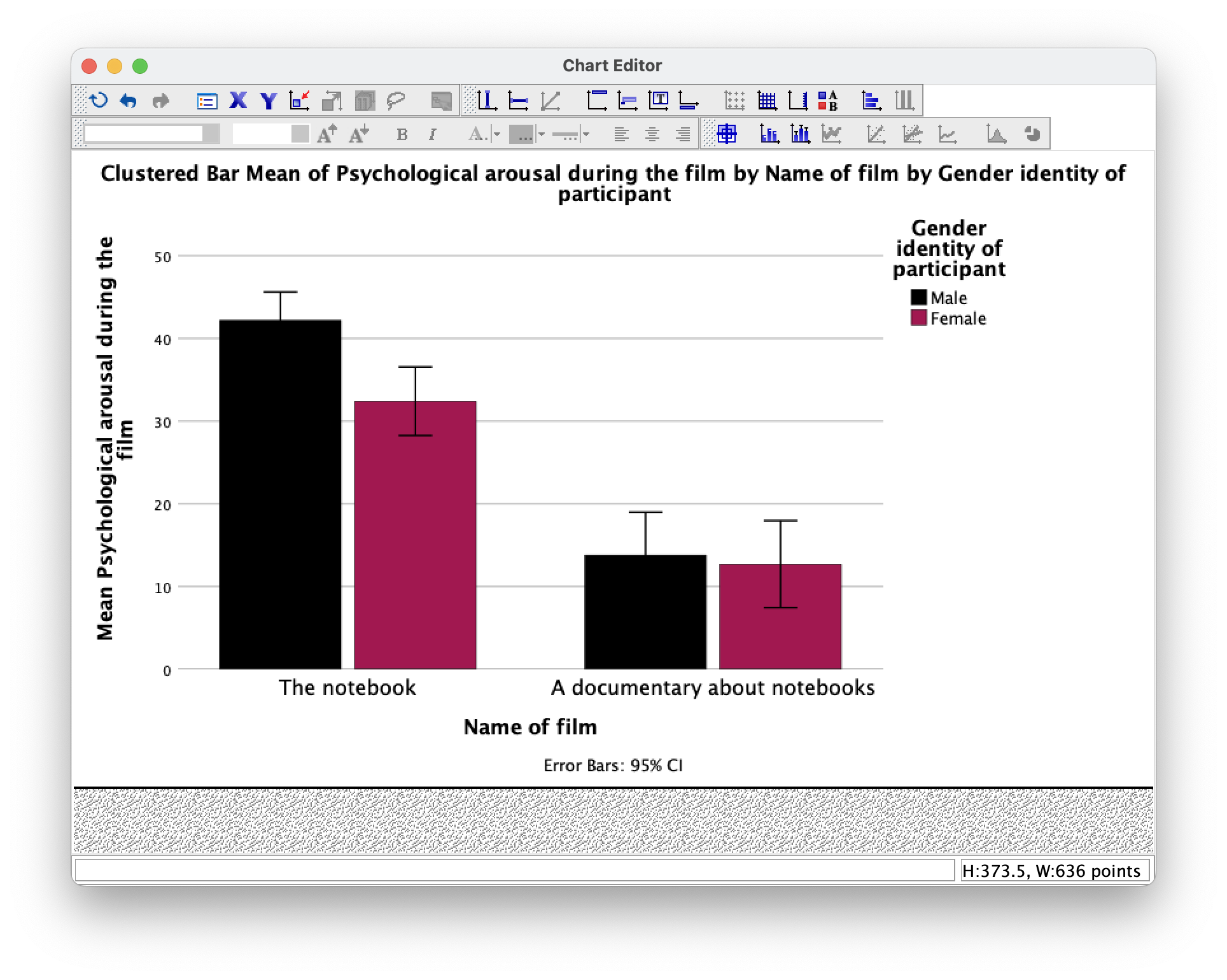

As an exercise to get you using some of the plot editing facilities we’re going to take one of the plots from the chapter and change some of its properties to produce a plot that loosely follows Tufte’s guidelines (minimal ink, no chartjunk, etc.). We’ll use the clustered bar plot for the arousal scores for the two films (The notebook and A documentary about notebooks) in Figure 5.21 in the book (Figure 9).

To edit this plot double-click on it in the SPSS Viewer. This will open the chart in the SPSS Chart Editor (Figure 10)

Editing the axes

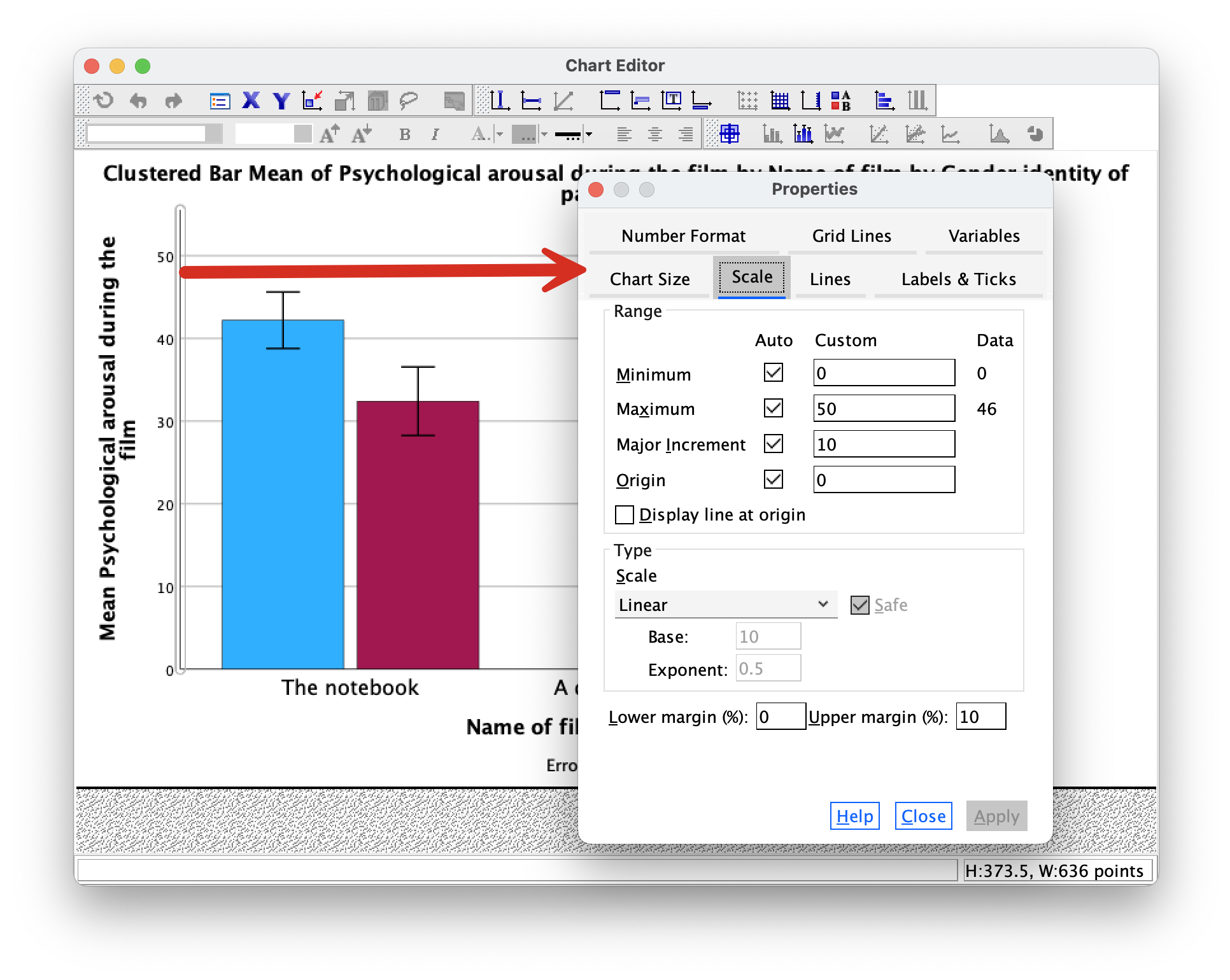

Now, let’s get rid of the axis lines – they’re just unnecessary ink! Select the y-axis by double-clicking on it with the mouse. It will become highlighted and a Properties dialog box will appear much the same as before (Figure 11). This dialog box has many tabs that allow us to change aspects of the y-axis. We’ll look at some of these in turn.

The Scale tab can be used to change the minimum, maximum and increments on the scale. Currently our plot is scaled from 0 to 50 and has a tick every 10 units (the major increment is, therefore, 10). This is fairly sensible but there is a lot of space at the top of the plot. Let’s see why. First change the Major Increment to 5. Click  and the scale of the y-axis should change in the Chart Editor . Note that even though the maximum is specified as 50, it goes up to 55. That’s weird isn’t it? This happens because the Upper Margin (%): is set to 10, so it’s adding 10% to the top of the scale (10% of 50 is 5, so we end up with a maximum of 55 instead of 50). Change the Upper Margin (%): to 0 and click

and the scale of the y-axis should change in the Chart Editor . Note that even though the maximum is specified as 50, it goes up to 55. That’s weird isn’t it? This happens because the Upper Margin (%): is set to 10, so it’s adding 10% to the top of the scale (10% of 50 is 5, so we end up with a maximum of 55 instead of 50). Change the Upper Margin (%): to 0 and click  . the y-axis will now be scaled from 0 to 50.

. the y-axis will now be scaled from 0 to 50.

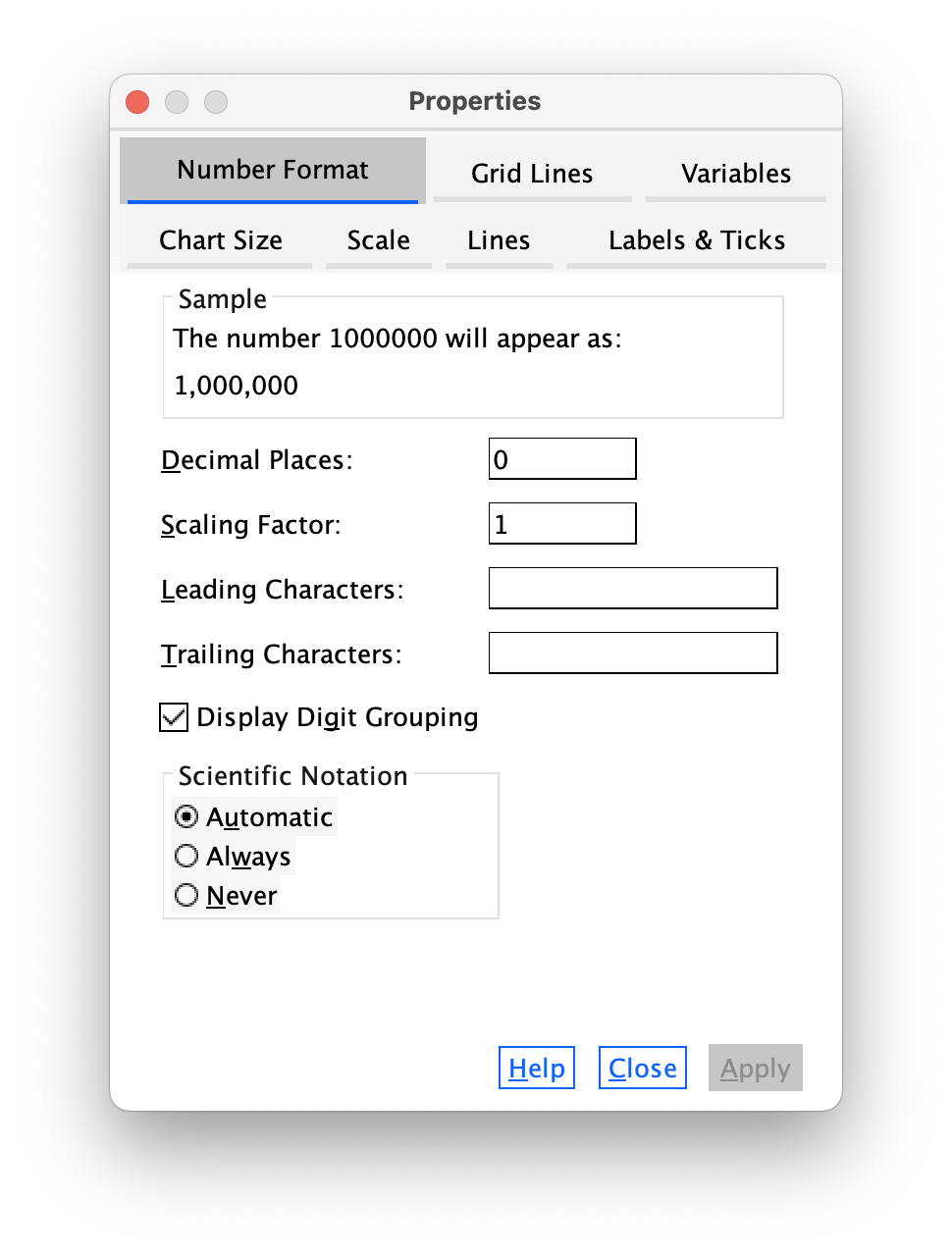

The Number Format tab (Figure 12) allows us to change the number format used on the y-axis. The default is to have 0 decimal places, which is sensible, but for other plots you can change the Decimal Places to be a value appropriate for your plot.

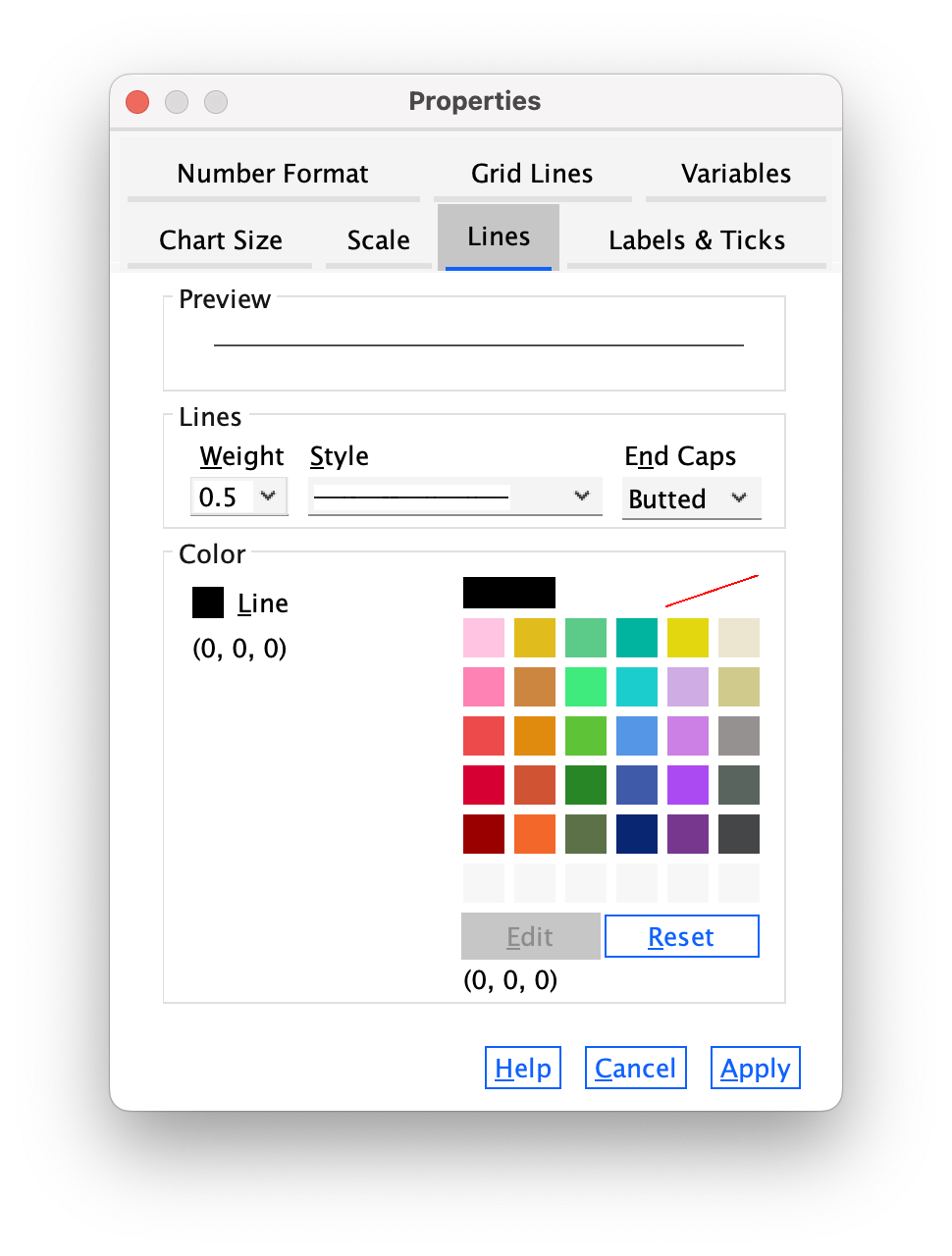

The Lines tab (Figure 13) allows us to change the properties of the axis itself. We don’t really need to have a line there at all, so let’s get rid of it. Click  and then click

and then click  . Click

. Click  and the y-axis line should vanish in the Chart Editor .

and the y-axis line should vanish in the Chart Editor .

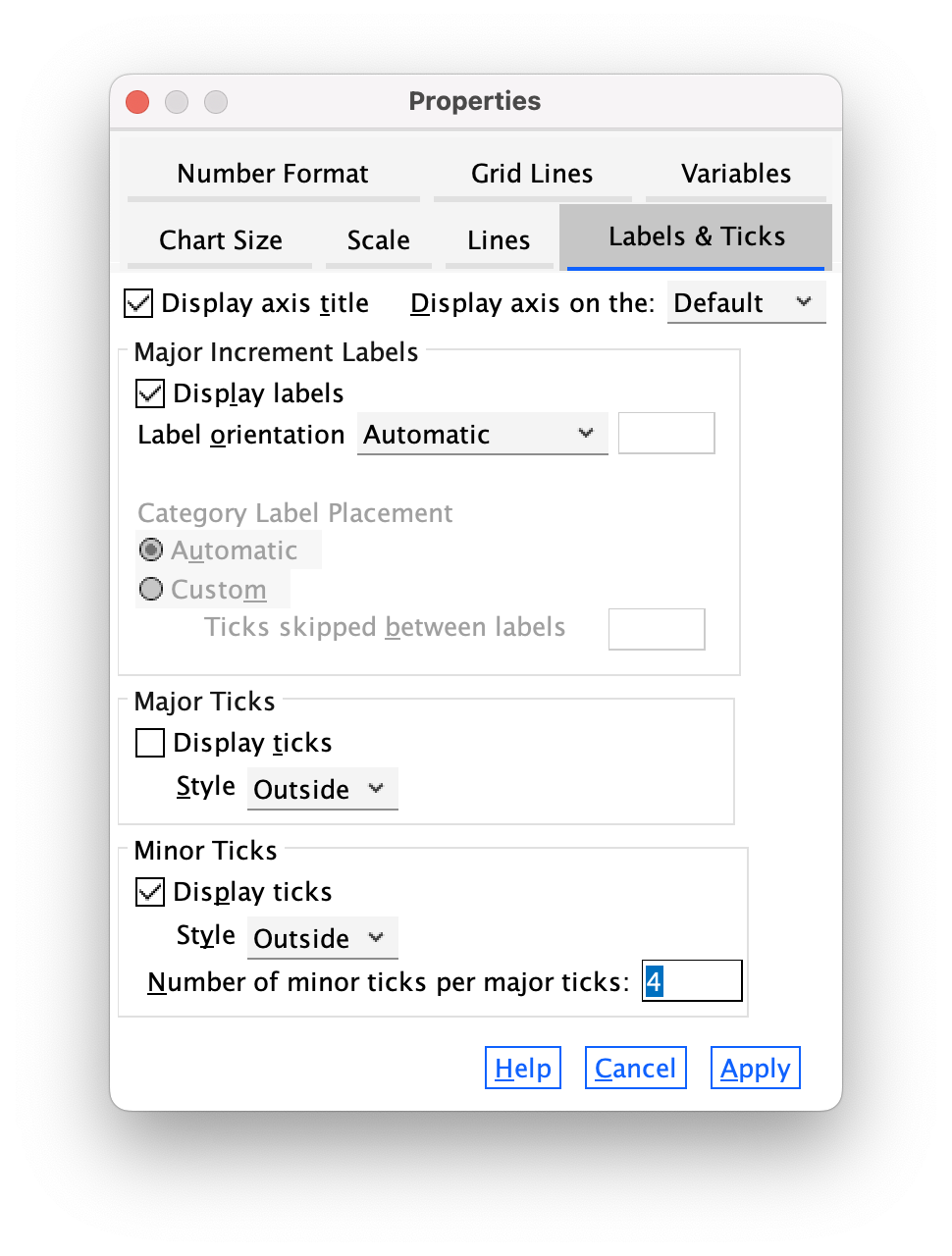

The Labels & Ticks tab (Figure 14) allows us to change various aspects of the ticks on the axis. The major increment ticks are shown by default (you should leave them there), and labels for them (the numbers) are shown by default also. These numbers are important, so leave the defaults alone. You could choose to display minor ticks. Let’s do this. Ask it to display the minor ticks. We have major ticks every 5, so it might be useful to have a minor tick every 1. To do this we need to set Number of minor ticks per major tick to be 4 and click  .

.

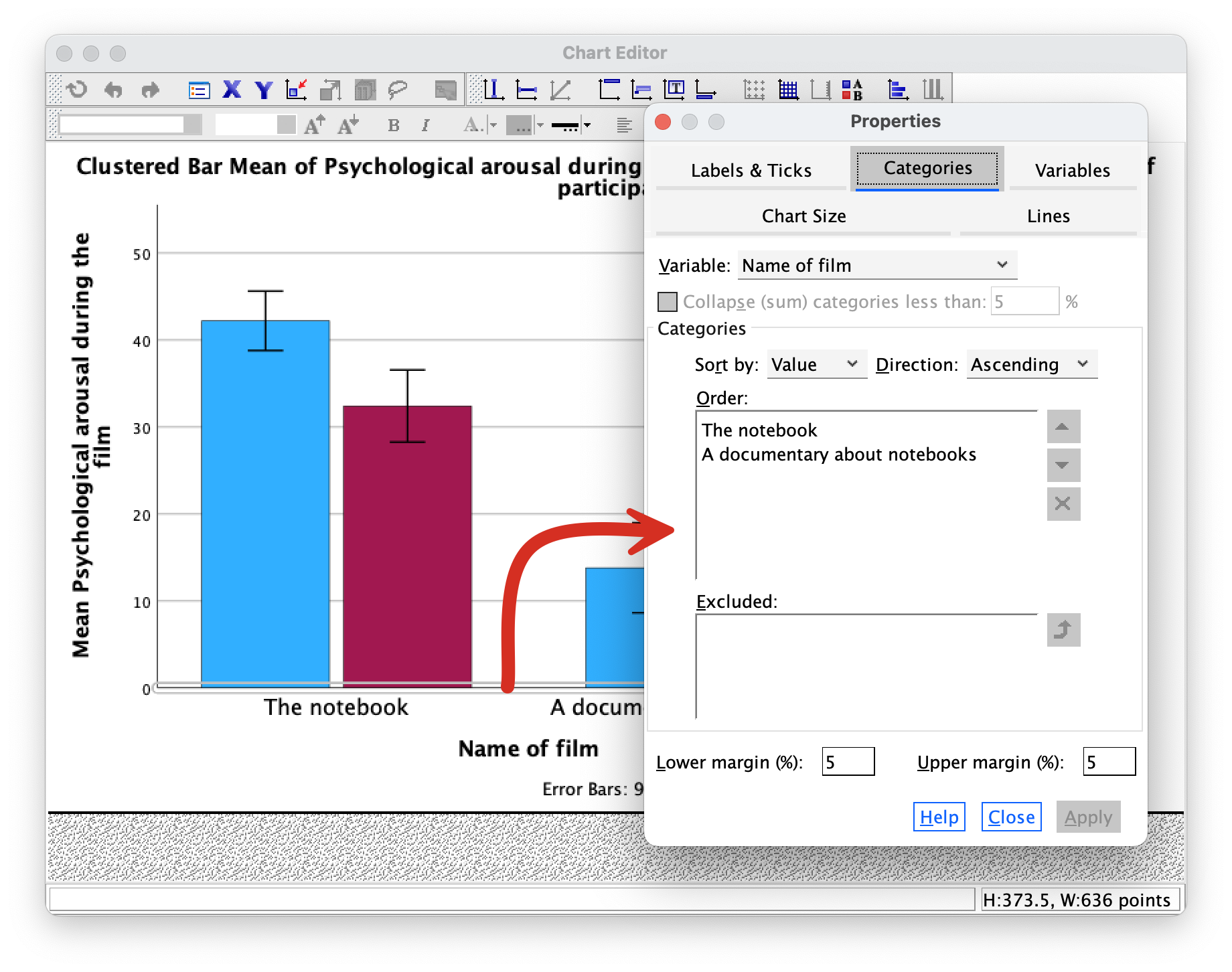

Let’s now edit the x-axis. To do this double-click on it in the Chart Editor . The axis will become highlighted and the Properties dialog box will open (Figure 15). Some of the properties tabs are the same as for the y-axis so we’ll just look at the ones that differ. Using what you have learnt already, set the line colour to be transparent so this it disappears (see the Lines tab above).

The Categories tab allows us to change the order of categories on this axis.

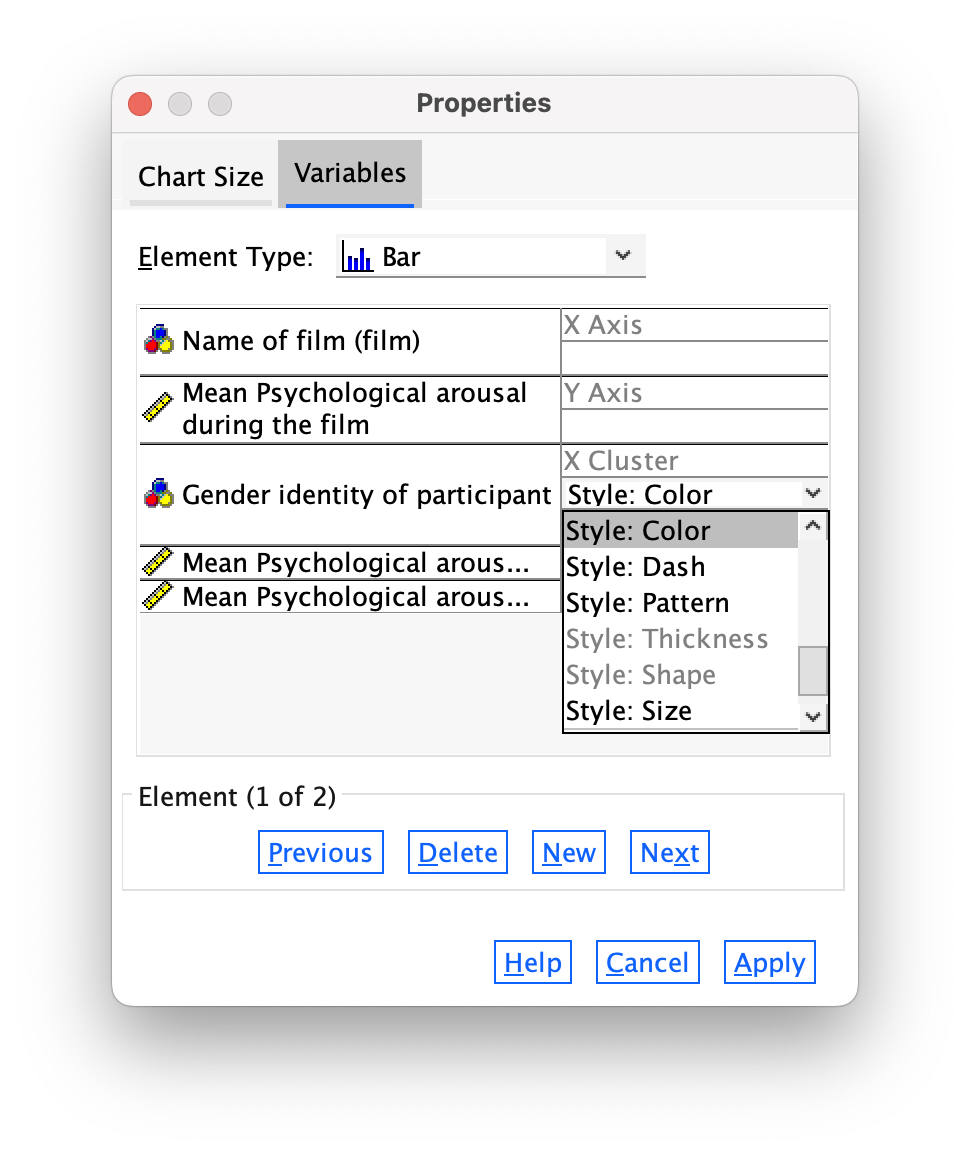

The Variables tab allows us to change properties of the variables. For one thing, if you don’t want a bar chart then there is a drop-down list of alternatives from which you can choose. Also we have sex displayed in different colours, but we can change this so that males and females are differentiated in other ways such as a pattern (Figure 16).

Editing the bars

To edit the bars, double-click on any of the bars to select them. They will become highlighted:

Let’s first change the colour of the blue bars. To do this we first need to click once on the blue bars. Now instead of all of the bars being highlighted, only the blue bars will be:

We can then use the Properties dialog box to change features of these bars.

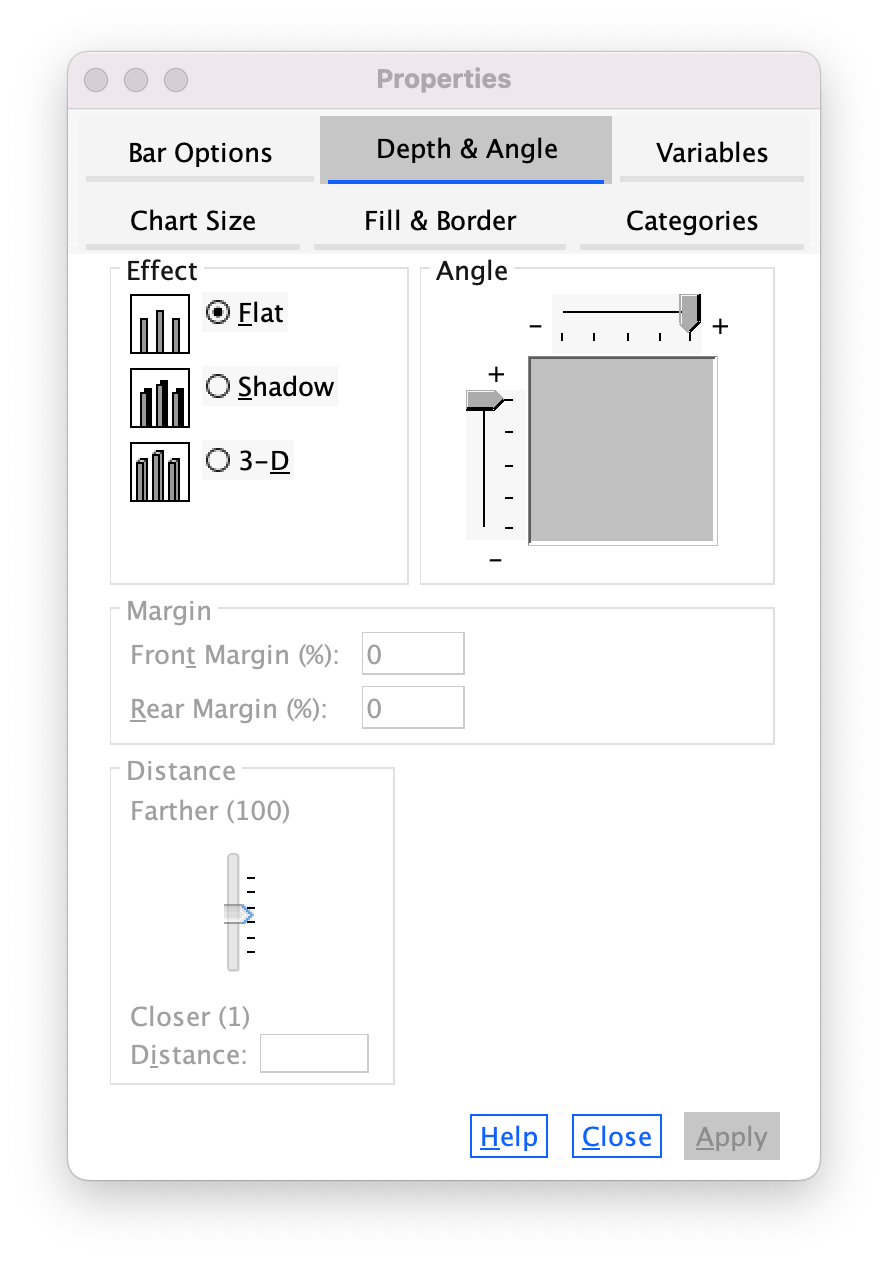

The Depth & Angle tab allows us to change whether the bars have a drop shadow or a 3-D effect. As I tried to stress in the book, you shouldn’t add this kind of chartjunk, so you should leave your bars as flat. However, in case you want to ignore my advice, Figure 19 is how you add chartjunk!

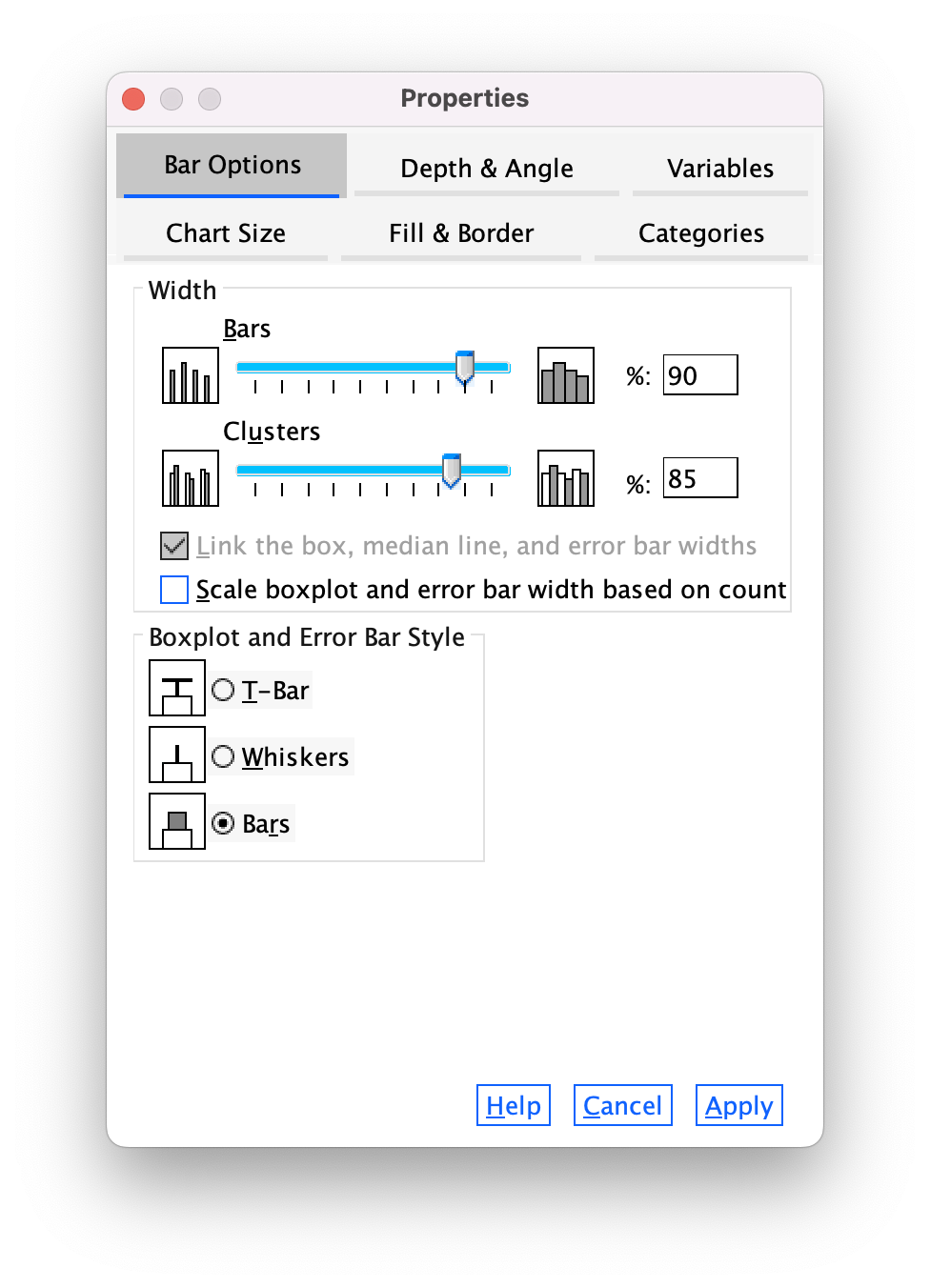

The Bar Options tab (Figure 20) allows us to change the width of the bars (the default is to have bars within a cluster touching, but if you reduce the bar width below 100% then a gap will appear). You can also alter the gap between clusters. The default allows a small gap between clusters (which is sensible) but you can reduce the gap by increasing the value up to 100% (no gap between clusters) or less (a gap between clusters).

You can also select whether the bars are displayed as bars (the default) or if you want them to appear as a line (Whiskers) or a T-bar (T-bar). This kind of plot really looks best if you leave the bars as bars (otherwise the error bars look silly).

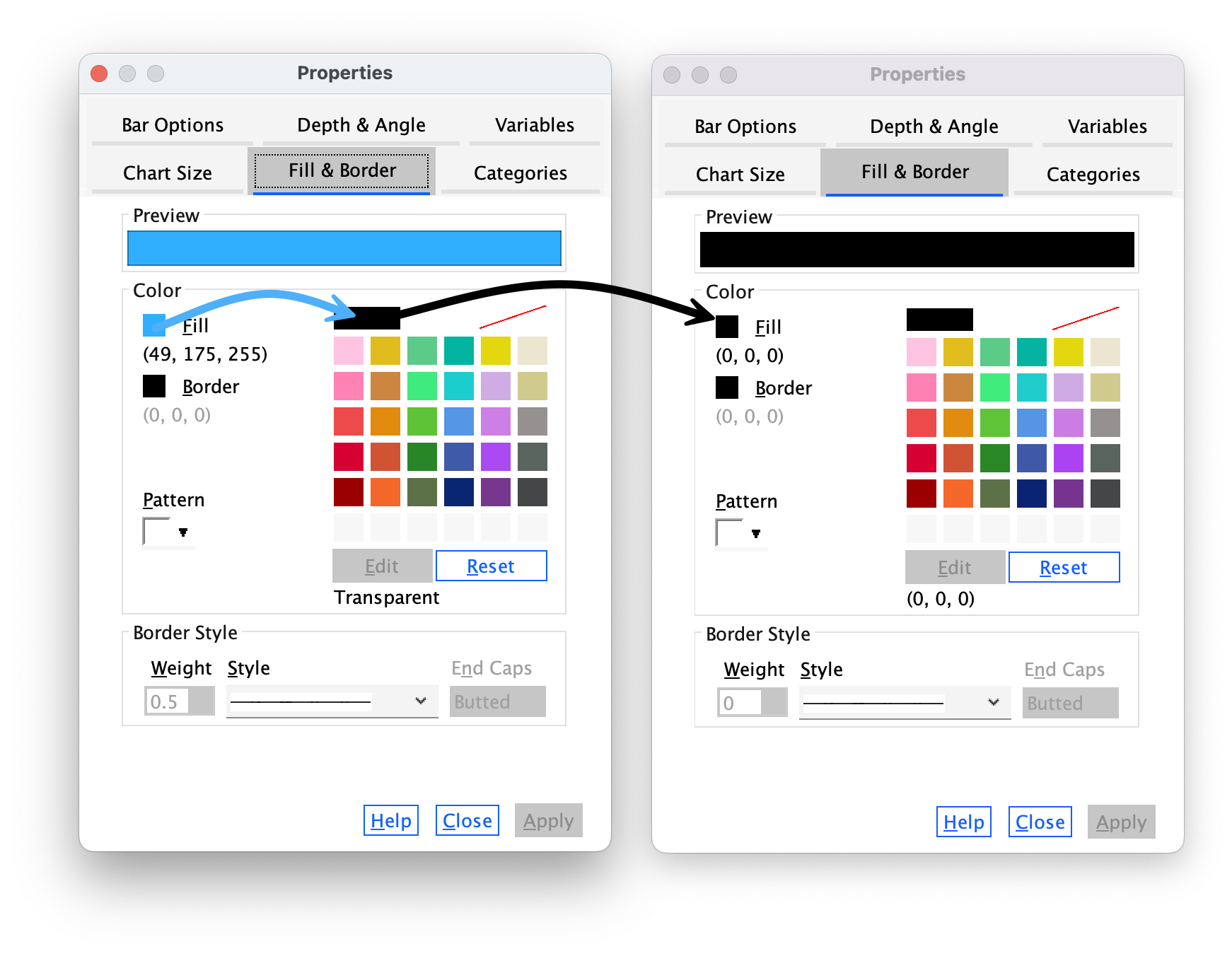

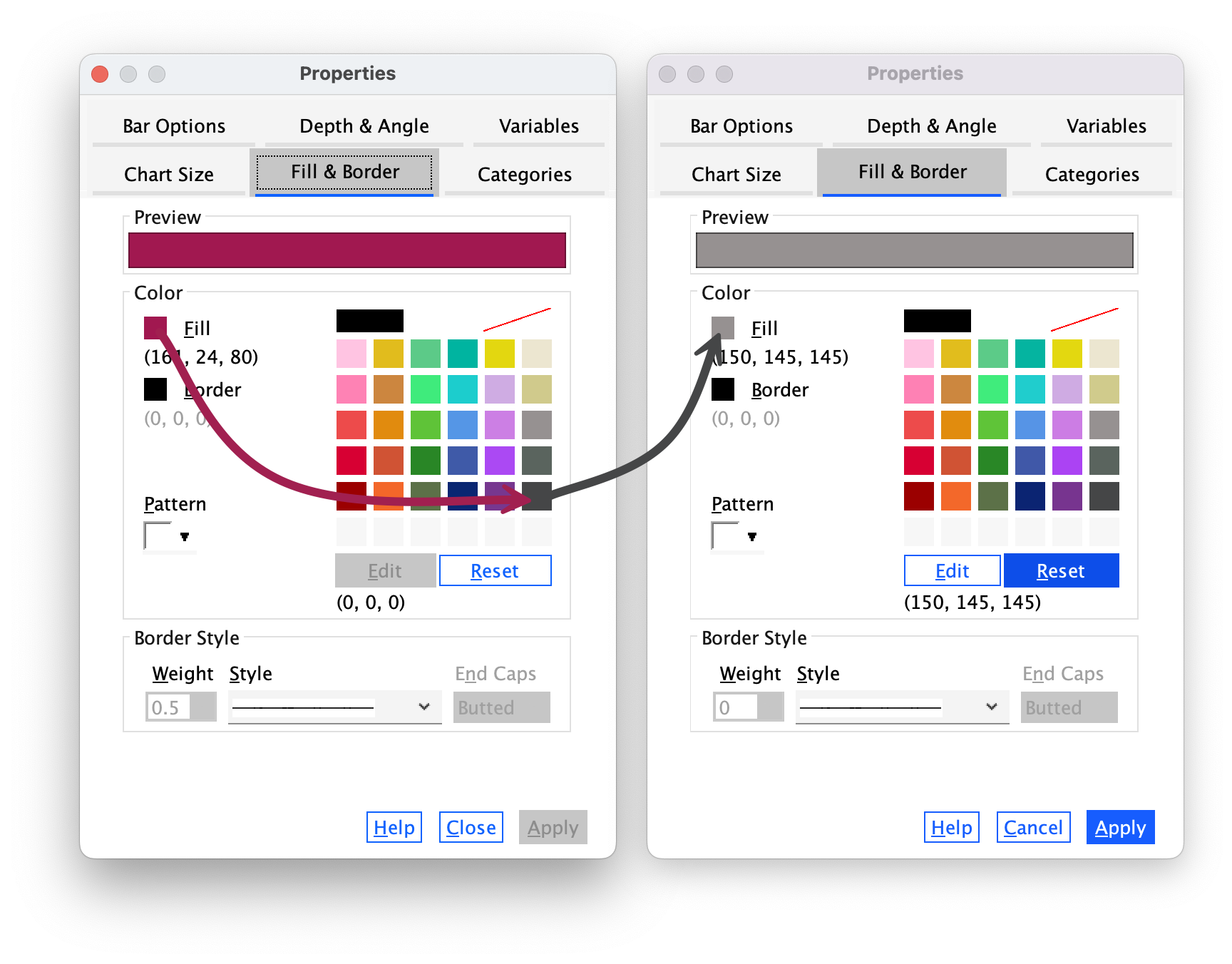

The Fill & Border tab (Figure 21) allows us to change the colour of the bar and the style and colour of the bar’s border. I want this bar to be black, so click  and then on the black square in the colour palette. Click

and then on the black square in the colour palette. Click and the blue bars should turn black.

and the blue bars should turn black.

Now we will change the colour of the red bars. To do this click once on the red bars to highlight them:

Use the Properties dialog boxes described above to change the colour of these bars. I want you to colour these bars grey:

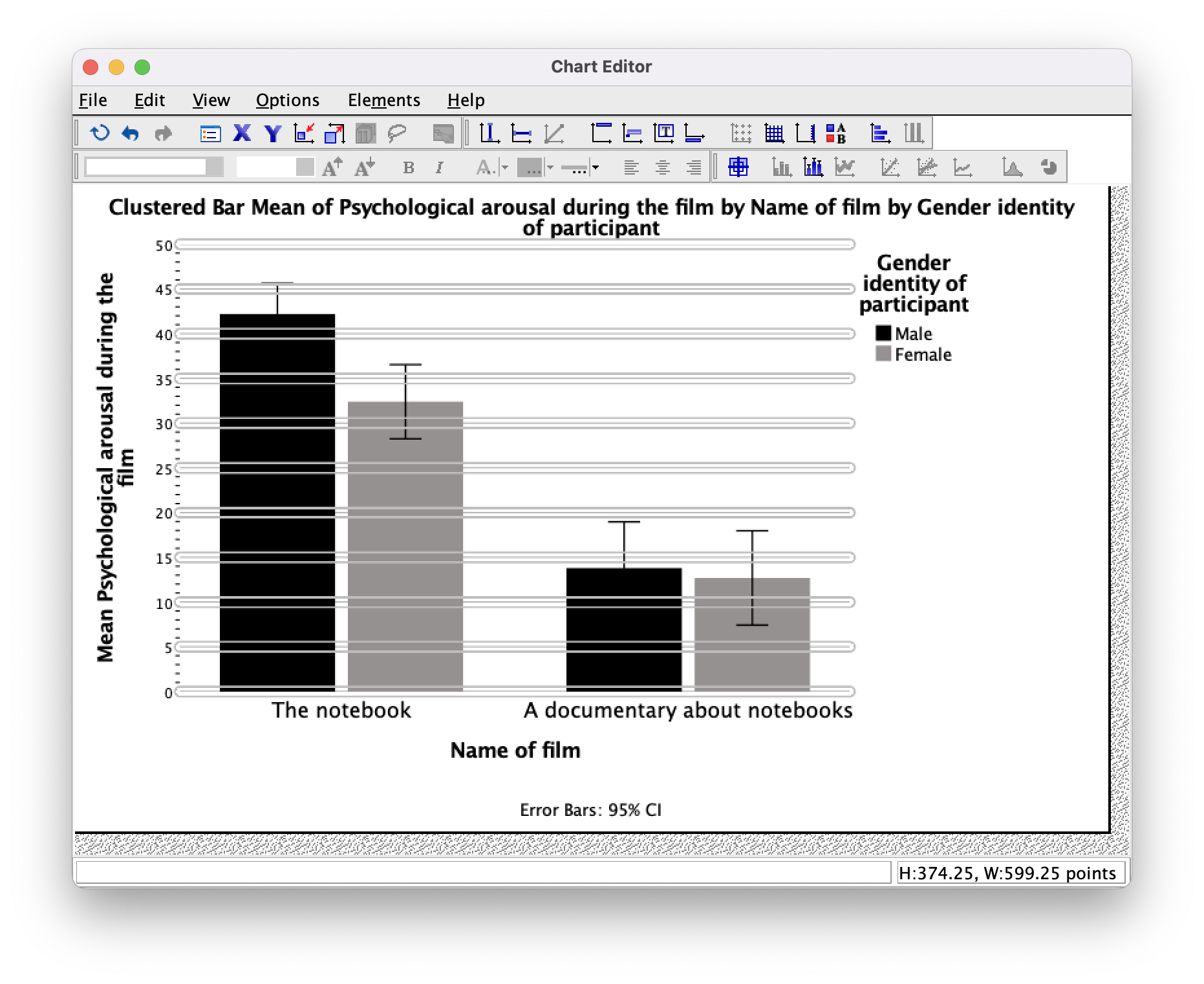

Editing grid lines

By defualt SPSS Statistics includes gridlines, but we can edit these. To do this click on any one of the horizontal grid lines in the Chart Editor so that they become highlighted (Figure 24).

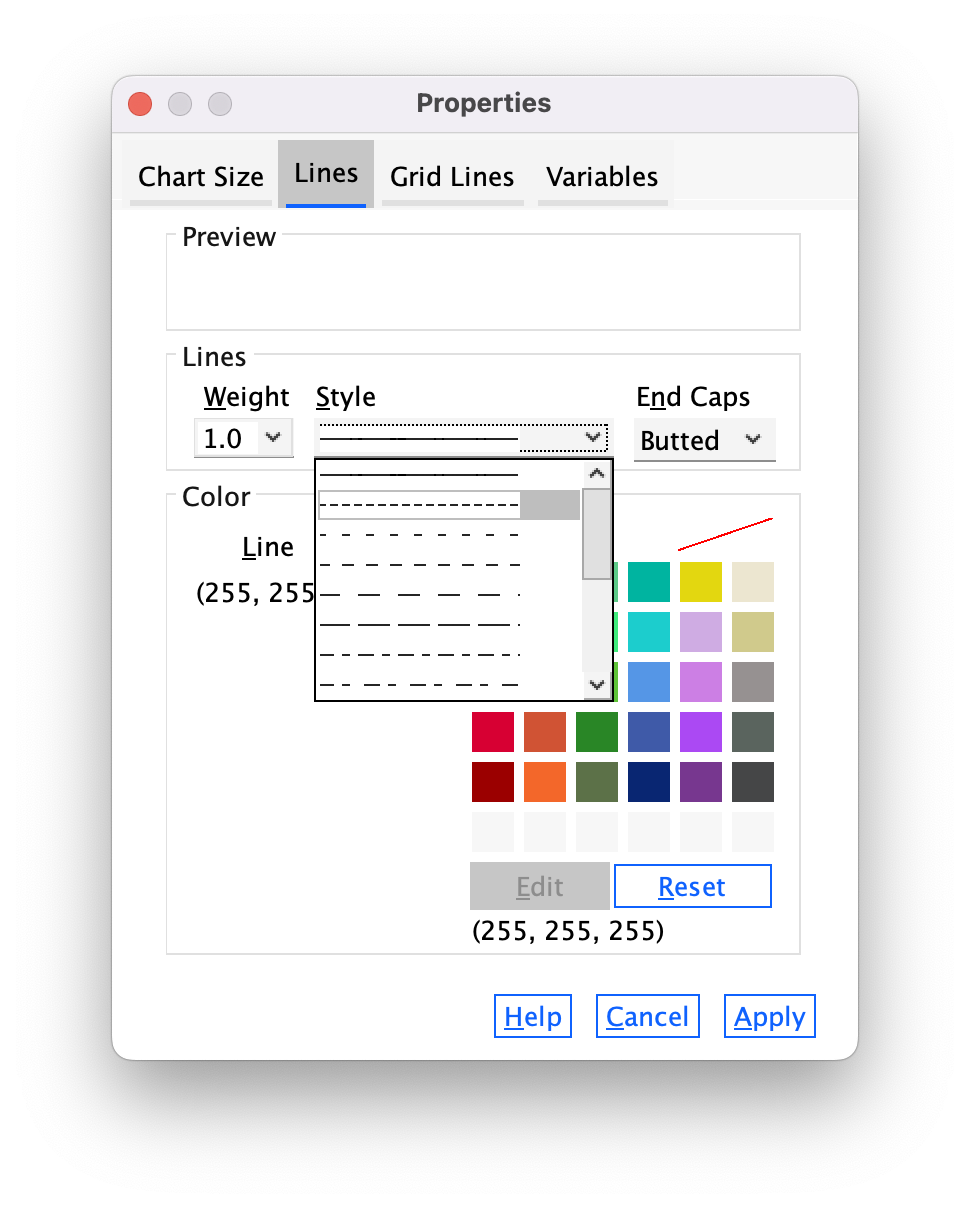

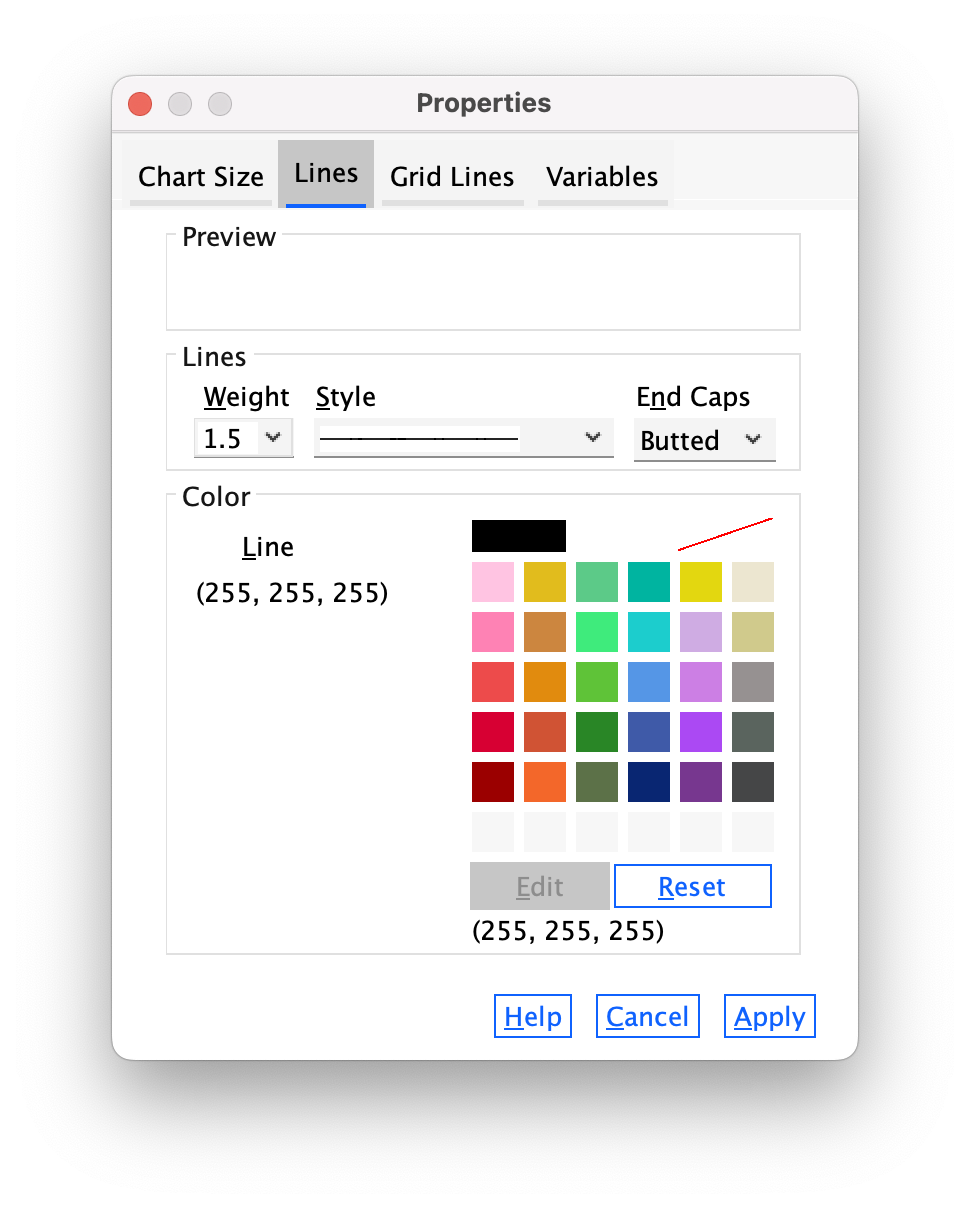

In the Properties dialog box select the Lines tab (Figure 25). You could change the grid lines to be dotted by selecting a dotted line from the Style drop-down list, but don’t, leave them as solid.

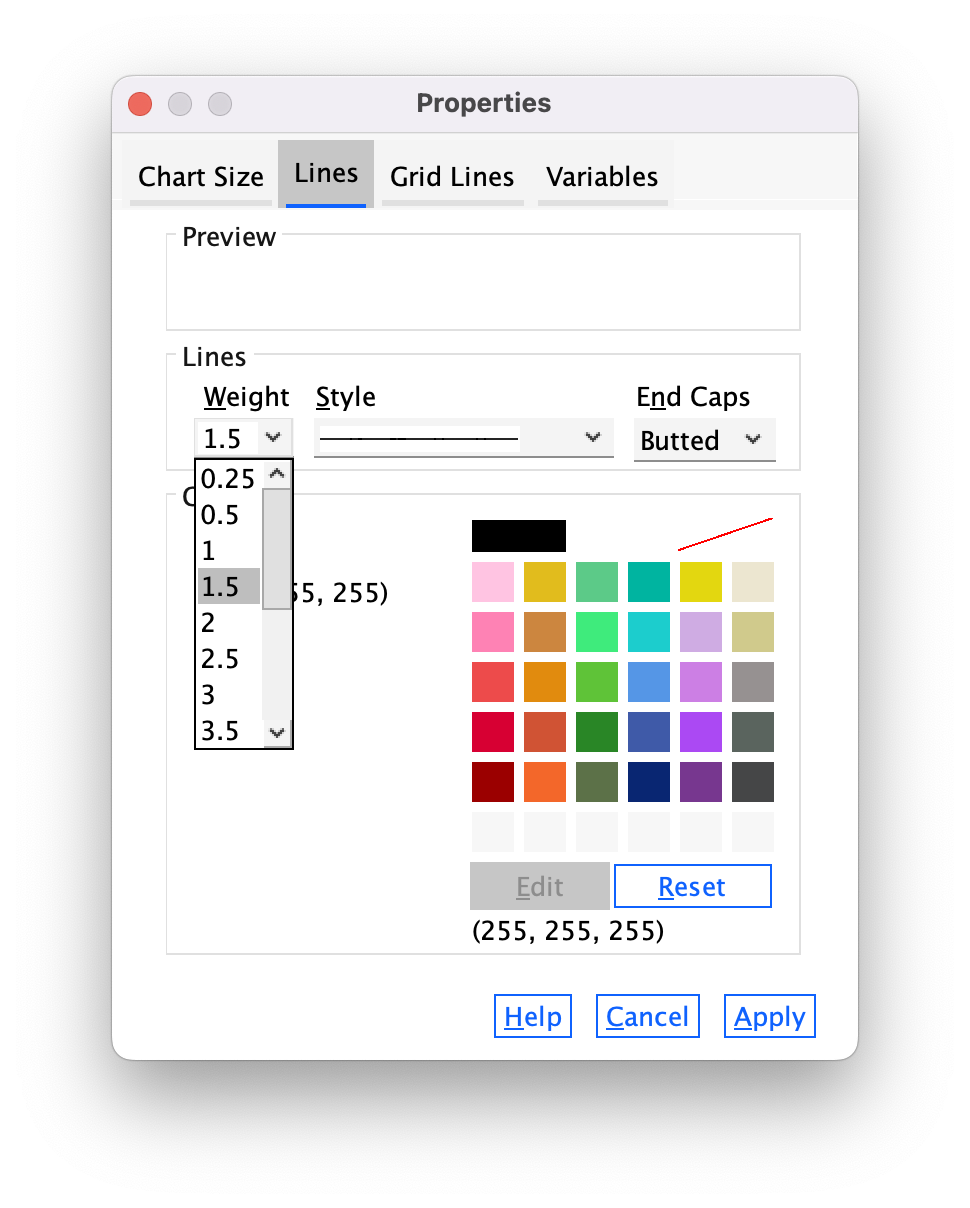

Next, let’s make the grid lines a bit thicker by selecting 1.5 from the Weight drop-down list (Figure 26).

Finally, let’s change their colour from black to white. We’ve used the colour palette a few times now so you should be able to do this without any help (Figure 27).

Click  and the horizontal grid lines should become white and thicker. Speaking of thick, you’ve probably noticed that you can no longer see them because we changed the colour to white and they are displayed on a white background. You’re probably also thinking that I must be some kind of idiot for telling you to do that. You’re probably right, but bear with me — there is method to the madness inside my rotting breadcrumb of a brain.

and the horizontal grid lines should become white and thicker. Speaking of thick, you’ve probably noticed that you can no longer see them because we changed the colour to white and they are displayed on a white background. You’re probably also thinking that I must be some kind of idiot for telling you to do that. You’re probably right, but bear with me — there is method to the madness inside my rotting breadcrumb of a brain.

Changing the order of elements of a plot

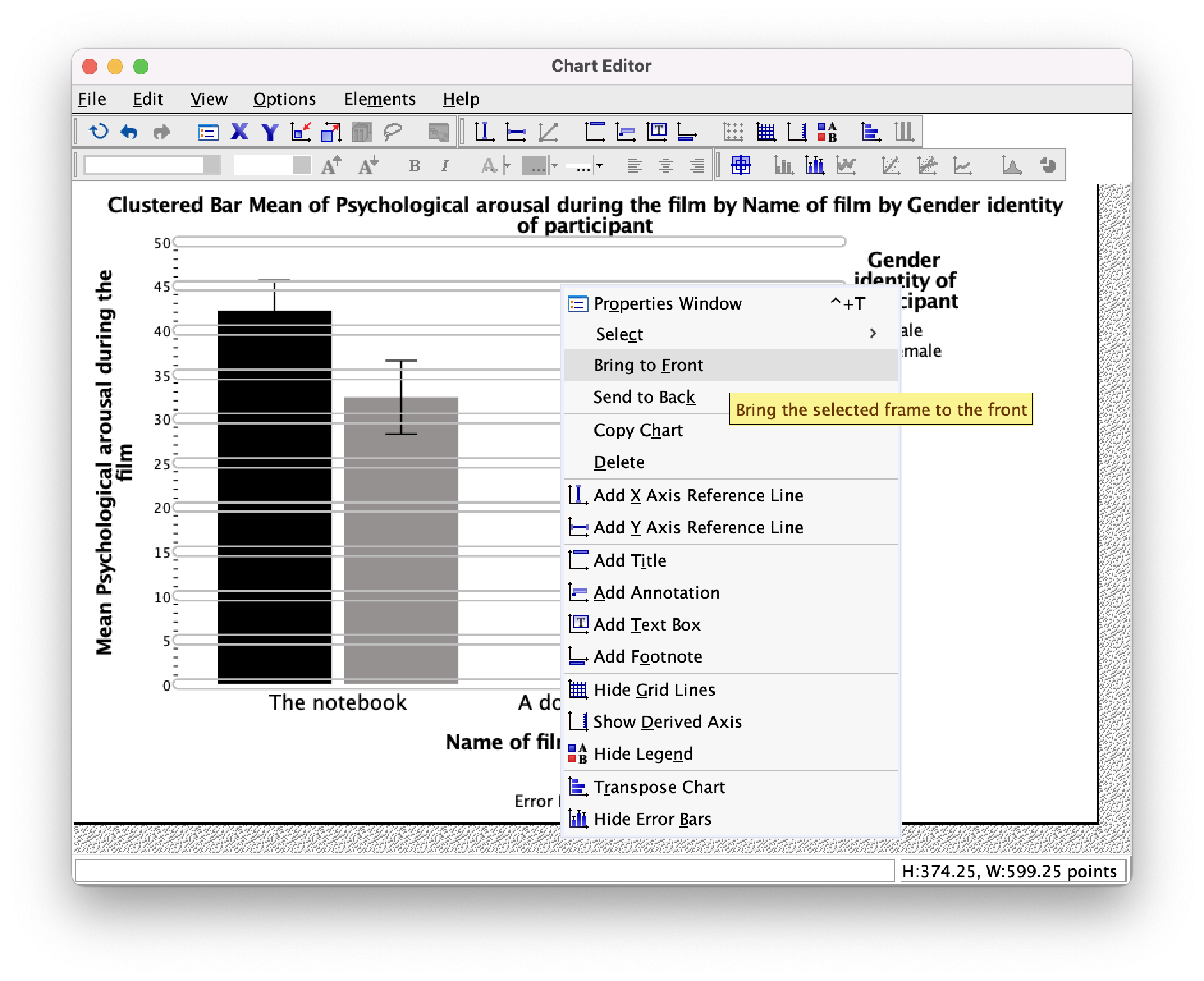

We’ve got white grid lines and we can’t see them. That’s a bit pointless isn’t it? However, we would be able to see them if they were in front of the bars. We can make this happen by again selecting the horizontal grid lines so that they are highlighted in yellow; then if we click on one of them with the right mouse button a menu appears on which we can select Bring to Front (Figure 28). Select this option and, wow, the grid lines become visible on the bars themselves: pretty cool, I think you’ll agree.

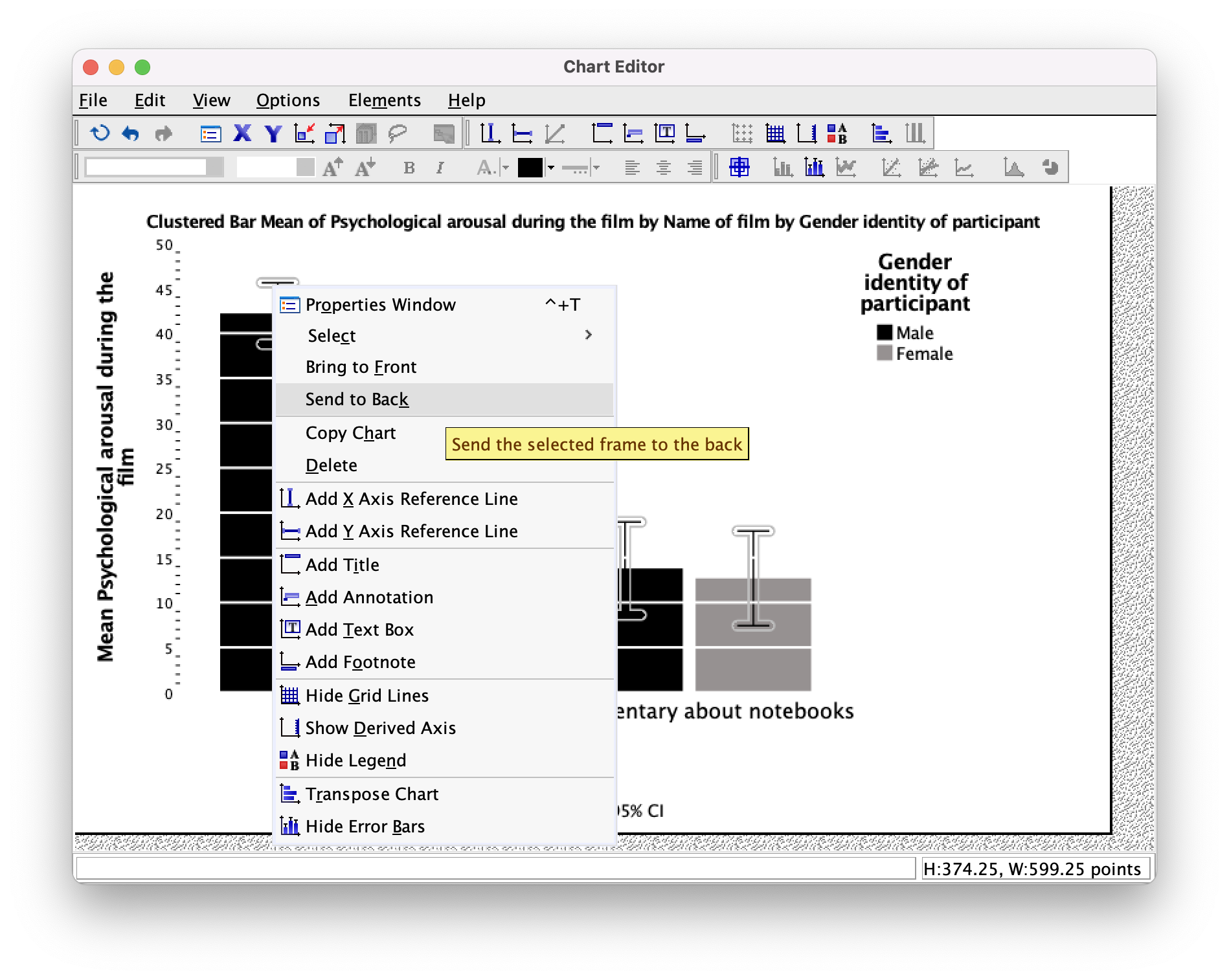

However, we still have a problem in that our error bars can be seen on top of the grey bars but not on top of the black bars. This looks a bit odd; it would be better if we could see them only poking out of the top on both bars. To do this, click on one of the error bars so that they become highlighted in yellow. Then if we click on one of them with the right mouse button a menu appears on which we can select Send to Back (Figure 29). Select this option and the error bas move behind the bars (therefore we can only see the top half).

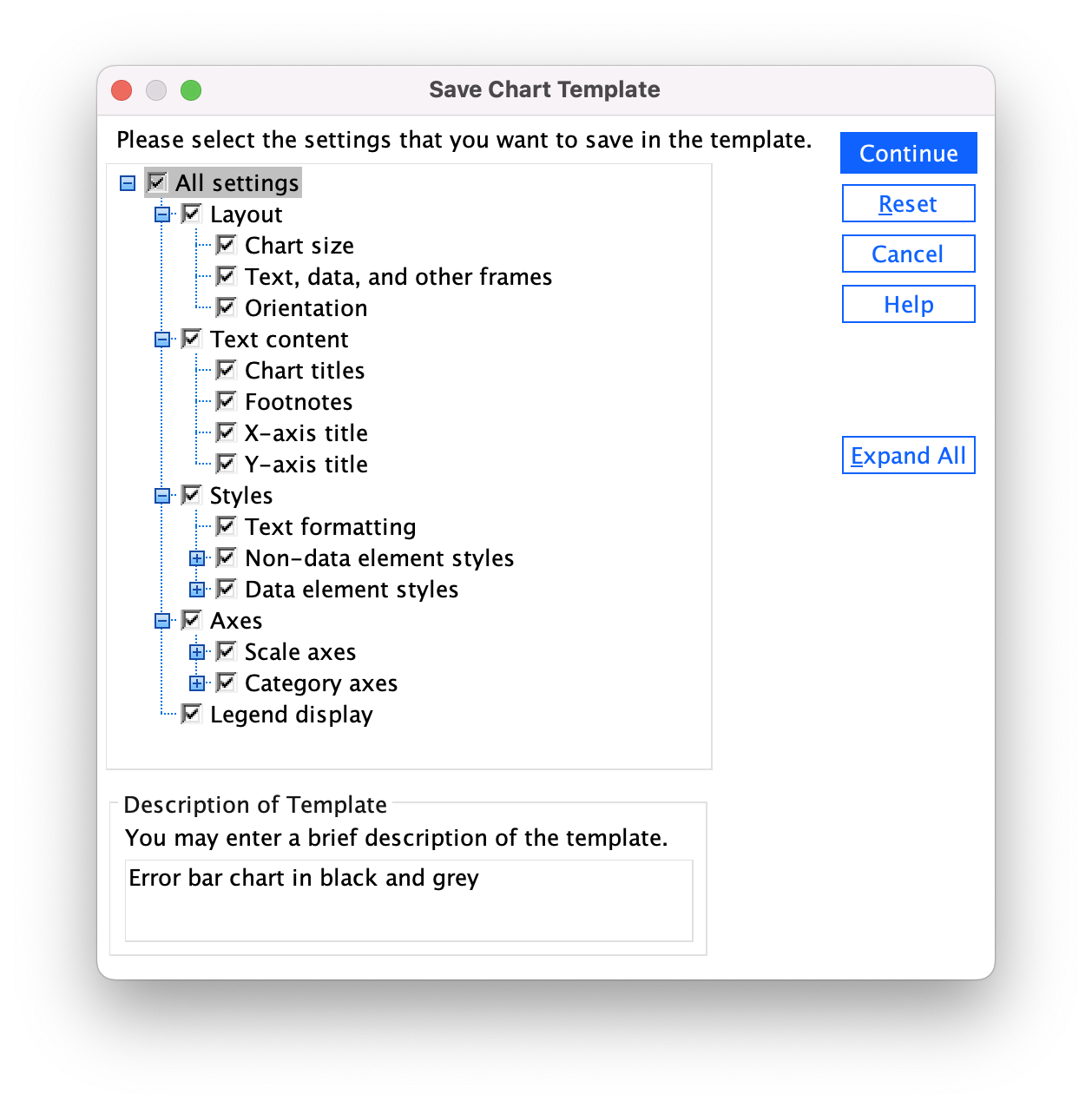

Saving a chart template

You’ve done all of this hard work. What if you want to produce a similar-looking plot? Well, you can save these settings as a template. A template is just a file that contains a set of instructions telling SPSS how to format a plot (e.g., you want grid lines, you want the axes to be transparent, you want the bars to be coloured black and grey, and so on). To do this, in the Chart Editor go to the File menu and select Save Chart Template. You will get a dialog box (Figure 30), and you should select what parts of the formatting you want to save (and add a description also). Although it is tempting to just click on ‘save all’, this isn’t wise because, for example, when we rescaled the y-axis we asked for a range of 0–50, and this is unlikely to be a sensible range for other plots, so this is one aspect of the formatting that we would not want to save.

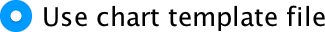

Click  and type a name for your template (e.g., greyscale_bar.sgt) in the subsequent dialog box and save. By default SPSS Statistics saves the templates in a folder called ‘Looks’, but you can save it elsewhere if you like. Assuming you have saved a chart template, you can apply it when you run a new plot in the Chart Editor by opening the Options tab, clicking

and type a name for your template (e.g., greyscale_bar.sgt) in the subsequent dialog box and save. By default SPSS Statistics saves the templates in a folder called ‘Looks’, but you can save it elsewhere if you like. Assuming you have saved a chart template, you can apply it when you run a new plot in the Chart Editor by opening the Options tab, clicking  and

and  and then browsing your computer for your template file:

and then browsing your computer for your template file:

Chapter 6

Please, Sir, can I have some more … normality tests?

If you want to test whether a model is a good fit of your data you can use a goodness-of-fit test (you can read about these in the chapter on categorical data analysis in the book), which has a chi-square test statistic (with the associated distribution). The Kolmogorov–Smirnov (K-S) test was developed as a test of whether a distribution of scores matches a hypothesized distribution (Massey, 1951). One good thing about the test is that the distribution of the K-S test statistic does not depend on the hypothesized distribution (in other words, the hypothesized distribution doesn’t have to be a particular distribution). It is also what is known as an exact test, which means that it can be used on small samples. It also appears to have more power to detect deviations from the hypothesized distribution than the chi-square test (Lilliefors, 1967). However, one major limitation of the K-S test is that if location (i.e. the mean) and shape parameters (i.e. the standard deviation) are estimated from the data then the K-S test is very conservative, which means it fails to detect deviations from the distribution of interest (i.e. normal). What Lilliefors did was to adjust the critical values for significance for the K-S test to make it less conservative (Lilliefors, 1967) using Monte Carlo simulations (these new values were about two-thirds the size of the standard values). He also reported that this test was more powerful than a standard chi-square test (and obviously the standard K-S test).

Another test historically used to test normality is the Shapiro–Wilk test (Shapiro & Wilk, 1965) which was developed specifically to test whether a distribution is normal (whereas the K-S test can be used to test against distributions other than normal). They concluded that their test was:

‘comparatively quite sensitive to a wide range of non-normality, even with samples as small as n = 20. It seems to be especially sensitive to asymmetry, long-tailedness and to some degree to short-tailedness’ (p. 608).

To test the power of these tests they applied them to several samples (n = 20) from various non-normal distributions. In each case they took 500 samples which allowed them to see how many times (in 500) the test correctly identified a deviation from normality (this is the power of the test). They show in these simulations (see Table 7 in their paper) that the Shapiro–Wilk test is considerably more powerful to detect deviations from normality than the K-S test. They verified this general conclusion in a much more extensive set of simulations as well (Shapiro et al., 1968).

Tests of normality (and indeed heterogeneity) were historically important. Before the advent of computers it was difficult and time-consuming to plot residuals and visualise data so statisticians relied on these sorts of tests to get an idea of whether their data conformed to the distributional properties they desired (or assumed). The advent of modern computing means that we no longer need these tests and (for reasons explained in the book) they are invariably misleading. So, although it is useful to acknowledge their historic use (and importance) it is even more important that we move beyond them.

Chapter 7

Please Sir, can I have some more … Jonck?

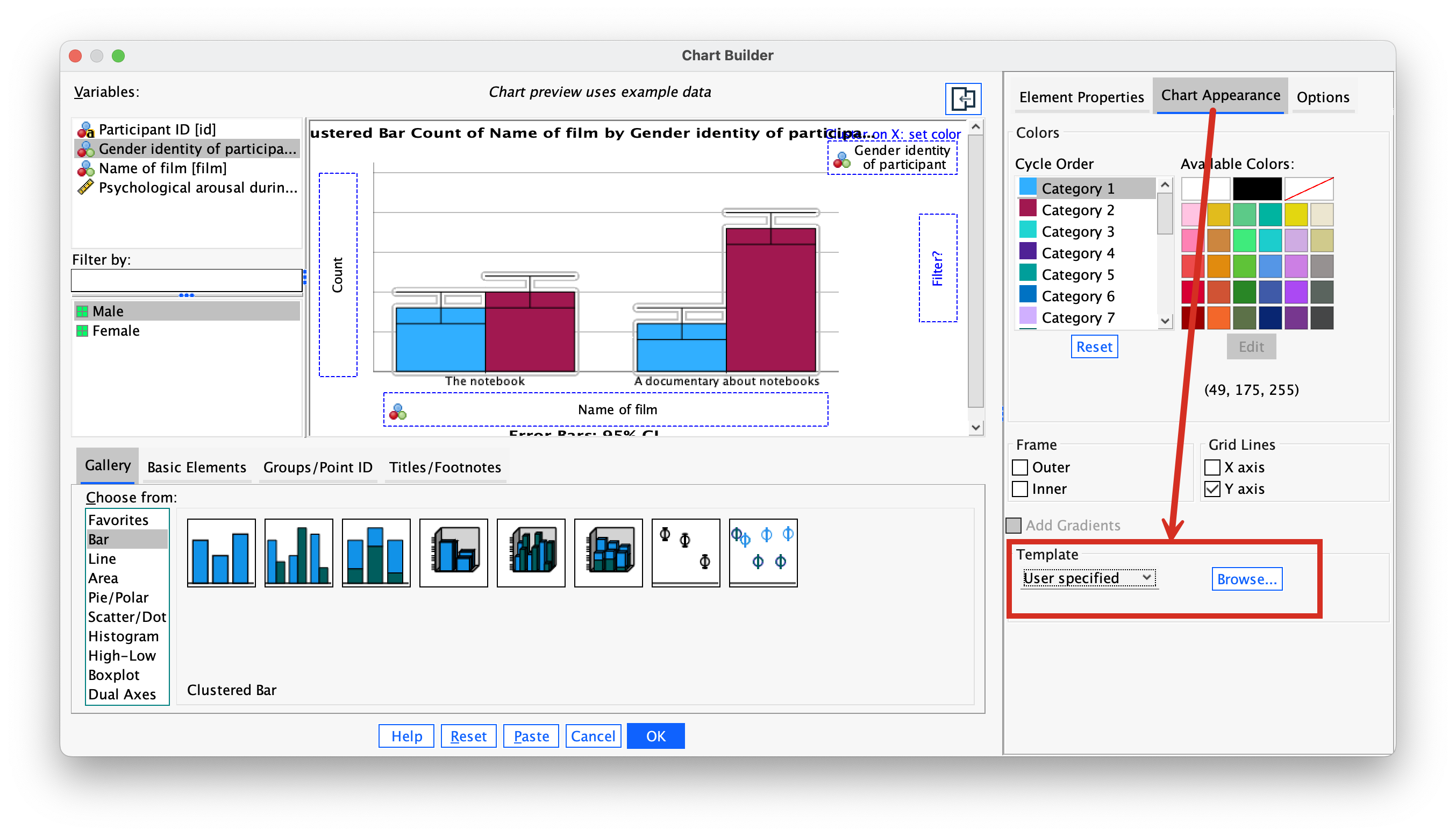

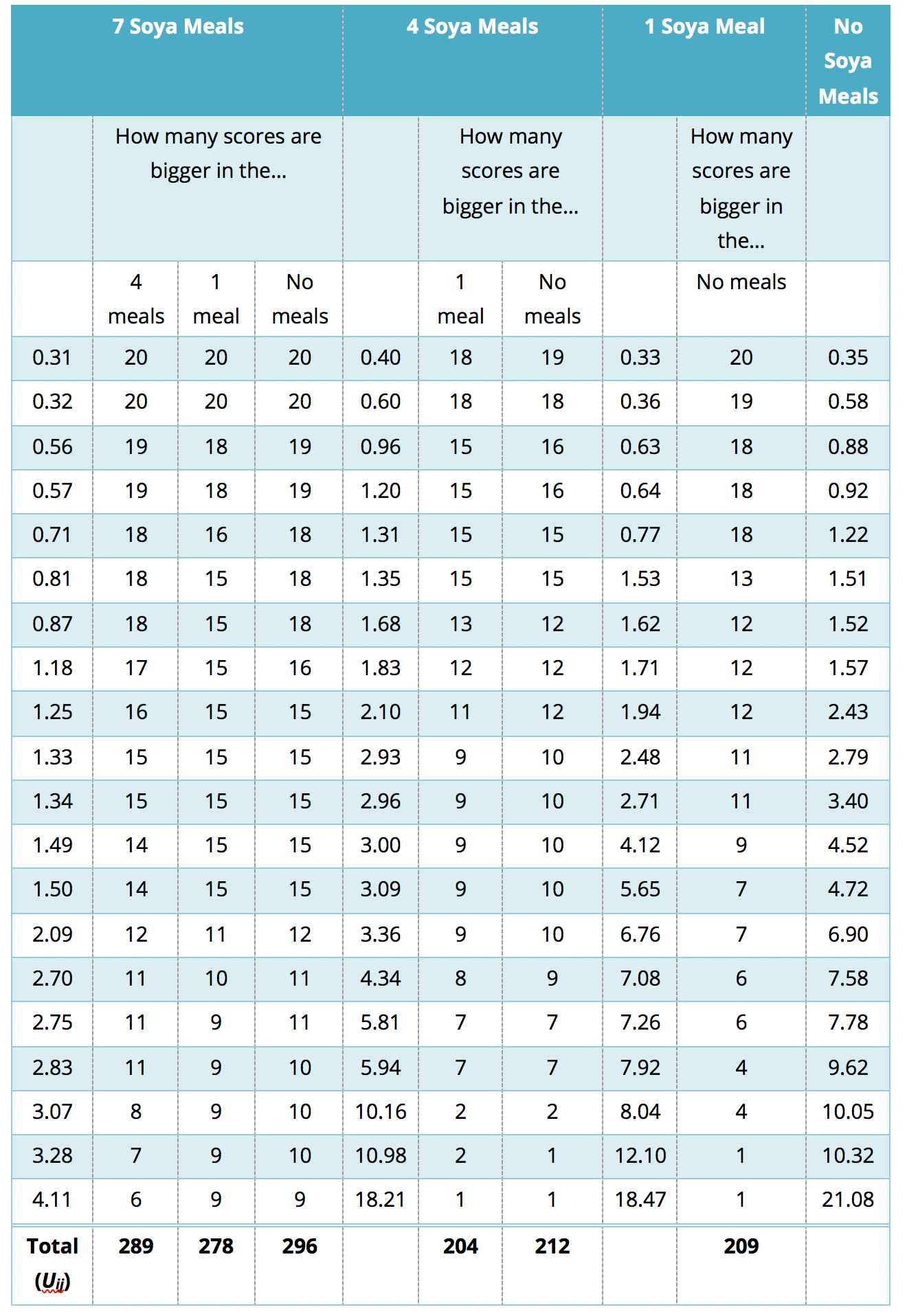

Jonckheere’s test is based on the simple, but elegant, idea of taking a score in a particular condition and counting how many scores in subsequent conditions are smaller than that score. So, the first step is to order your groups in the way that you expect your medians to change. If we take the soya example, then we expect sperm counts to be highest in the no soya meals condition, and then decrease in the following order: 1 meal per week, 4 meals per week, 7 meals per week. So, we start with the no meals per week condition, and we take the first score and ask ‘How many scores in the next condition are bigger than this score?’.

You’ll find that this is easy to work out if you arrange your data in ascending order in each condition. The table in Figure 32 shows a convenient way to lay out the data. Note that the sperm counts have been ordered in ascending order and the groups have been ordered in the way that we expect our medians to decrease. So, starting with the first score in the no soya meals group (this score is 0.35), we look at the scores in the next condition (1 soya meal) and count how many are greater than 0.35. It turns out that all 19 of the 20 scores are greater than this value, so we place the value of 19 in the appropriate column and move onto the next score (0.58) and do the same. When we’ve done this for all of the scores in the no meals group, we go back to the first score (0.35) again, but this time count how many scores are bigger in the next but one condition (the 4 soya meal condition). It turns out that 18 scores are bigger so we register this in the appropriate column and move onto the next score (0.58) and do the same until we’ve done all of the scores in the 7 meals group. We basically repeat this process until we’ve compared the first group with all subsequent groups.

At this stage we move onto the next group (the 1 soya meal condition). Again, we start with the first score (0.33) and count how many scores are bigger than this value in the subsequent group (the 4 meals group). In this case there all 20 scores are bigger than 0.33, so we register this for all scores and then go back to the beginning of this group (i.e. back to the first score of 0.33) and repeat the process until this category has been compared with all subsequent categories. When all categories have been compared with all subsequent categories in this way, we simply add up the counts as I have done in the table (Figure 32). These sums of counts are denoted by \(U_{ij}\).

The test statistic, J, is the sum of these counts

\[ J = \sum_{i<j}^k{U_{ij}}, \]

which for these data is

\[ \begin{align} J &= \sum_{i<j}^k{U_{ij}} \\ &= 193 + 187 + 104 + 195 + 122 + 111 \\ &= 912. \end{align} \]

For small samples there are specific tables to look up critical values of J; however, when samples are large (anything bigger than about 8 per group would be large in this case) the sampling distribution of J becomes normal with a mean and standard deviation of

\[ \begin{align} \bar{J} &= \frac{N^2-\sum{n_k^2}}{4} \\ \sigma_j &= \sqrt{\frac{1}{72}\big[ N^2(2N+3)-\sum{n_k^2(2n_k+3)}\big]}\\ \end{align} \]

in which N is simply the total sample size (in this case 80) and \(n_k\) is the sample size of group k (in each case in this example this will be 20 because we have equal sample sizes). So, we square each group’s sample size and add them up, then subtract this the result by 4. Therefore, we can calculate the mean for these data as

\[ \begin{align} \bar{J} &= \frac{80^2-(20^2+20^2+20^2+20^2)}{4} \\ &= \frac{4800}{4} \\ &= 1200. \end{align} \]

The standard deviation can similarly be calculated using the sample sizes of each group and the total sample size

\[ \begin{align} \sigma_j &= \sqrt{\frac{1}{72}\bigg[80^2(2\times 80+3)-\big[20^2(2 \times 20 + 3) + 20^2(2 \times 20 + 3) + 20^2(2 \times 20 + 3) + 20^2(2 \times 20 + 3)\big]\bigg]} \\ &= \sqrt{\frac{1}{72}\bigg[6400(163) - \big[400(43) + 400(43) + 400(43) + 400(43)\big]}\\ & = \sqrt{\frac{1}{72}[1043200 - 68800]} \\ & = \sqrt{1353333} \\ & = 116.33. \end{align} \]

We can use the mean and standard deviation to convert J to a z-score using the standard formulae

\[ \begin{align} z &= \frac{X-\bar{X}}{s} \\ &= \frac{J-\bar{J}}{\sigma_j}\\ &= \frac{912-1200}{116.33} \\ &= -2.476. \end{align} \]

This z can then be evaluated using the critical values in the Appendix of the book. This test is always one-tailed because we have predicted a trend to use the test. So we’re looking at z being above 1.65 (when ignoring the sign) to be significant at α = .05. In fact, the sign of the test tells us whether the medians ascend across the groups (a positive z) or descend across the groups (a negative z) as they do in this example.

I have just shown how to use the test when the groups are ordered by descending medians (i.e. we expect sperm counts to be highest in the no soya meals condition, and then decrease in the following order: 1 meal per week, 4 meals per week, 7 meals per week; so we ordered the groups: No soya, I meal, 4 meals and 7 meals). Certain books will tell you to order the groups in ascending order (start with the group that you expect to have the lowest median). For the soya data this would mean arranging the groups in the opposite order to how I did above; that is, 7 meals, 4 meals, 1 meal and no meals. The purpose of this section is to show you what happens if we order the groups the opposite way around!

The process is similar to that used in the Appendix, only now we start with start with the 7 meals per week condition, and we take the first this score?’ You’ll find that this is easy to work out if you arrange your data in ascending order in each condition. The table in Figure 33 shows a convenient way to lay out the data. Note that the sperm counts have been ordered in ascending order and the groups have been ordered in the way that we expect our medians to increase. So, starting with the first score in the 7 soya meals group (this score is 0.31), we look at the scores in the next condition (4 soya meals) and count how many are greater than 0.31. It turns out that all 20 scores are greater than this to the next score (0.32) and do the same. When we’ve done this for all of the scores in the 7 meals group, we go back to the first score (0.31) again, but this time count how many scores are bigger in the next but one condition (the 1 soya meal condition). It turns out that all 20 so we register this in the appropriate column and move on to the next score (0.32) and do the same until we’ve done all of the scores in the 7 meals group. We basically repeat this process until we’ve compared the first group to all subsequent groups.

At this stage we move on to the next group (the 4 soya meals). Again, we start with the first score (0.40) and count how many scores are bigger than this value in the subsequent group (the 1 meal group). In this case are 18 scores bigger than 0.40, so we register this in the table and move on to the next score (0.60). Again, we repeat this for all scores and then go back to the beginning of this group (i.e. back to the first score of 0.40) and repeat the process until this category has been compared to all subsequent categories. When all categories have been counts as I have done in the table (Figure 33). These sums of counts are again denoted by \(U_{ij}\). As before, test statistic J is the sum of these counts, which for these data is

\[ \begin{align} J &= \sum_{i<j}^k{U_{ij}} \\ &= 289 + 278 + 296 + 204 + 212 + 209 \\ &= 1488. \end{align} \]

As I said earlier, for small samples there are specific tables to look up critical values of J; however, when samples are large (anything bigger than about 8 per group would be large in this case) the sampling distribution of J becomes normal with a mean and standard deviation that we defined before. The data haven’t changed so the values of the mean and standard deviation are the same as we calculated earlier.

We can use the mean and standard deviation to convert J to a z-score as we did before. All the values will be the same except for the test statistic (which is now 1488 rather than 912):

\[ \begin{align} z &= \frac{J-\bar{J}}{\sigma_j}\\ &= \frac{1488-1200}{116.33} \\ &= 2.476. \end{align} \]

Note that the z-score is the same value as when we ordered the groups in descending order, except that it now has a positive value rather than a negative one! This illustrates what I wrote earlier: the sign of the test tells us whether the medians ascend across the groups (a positive z) or descend across the groups (a negative z)! Earlier we ordered the groups in descending order and so got a negative z, and now we ordered them in ascending order and so got a positive z.

Chapter 8

Please, Sir, can I have some more … options?

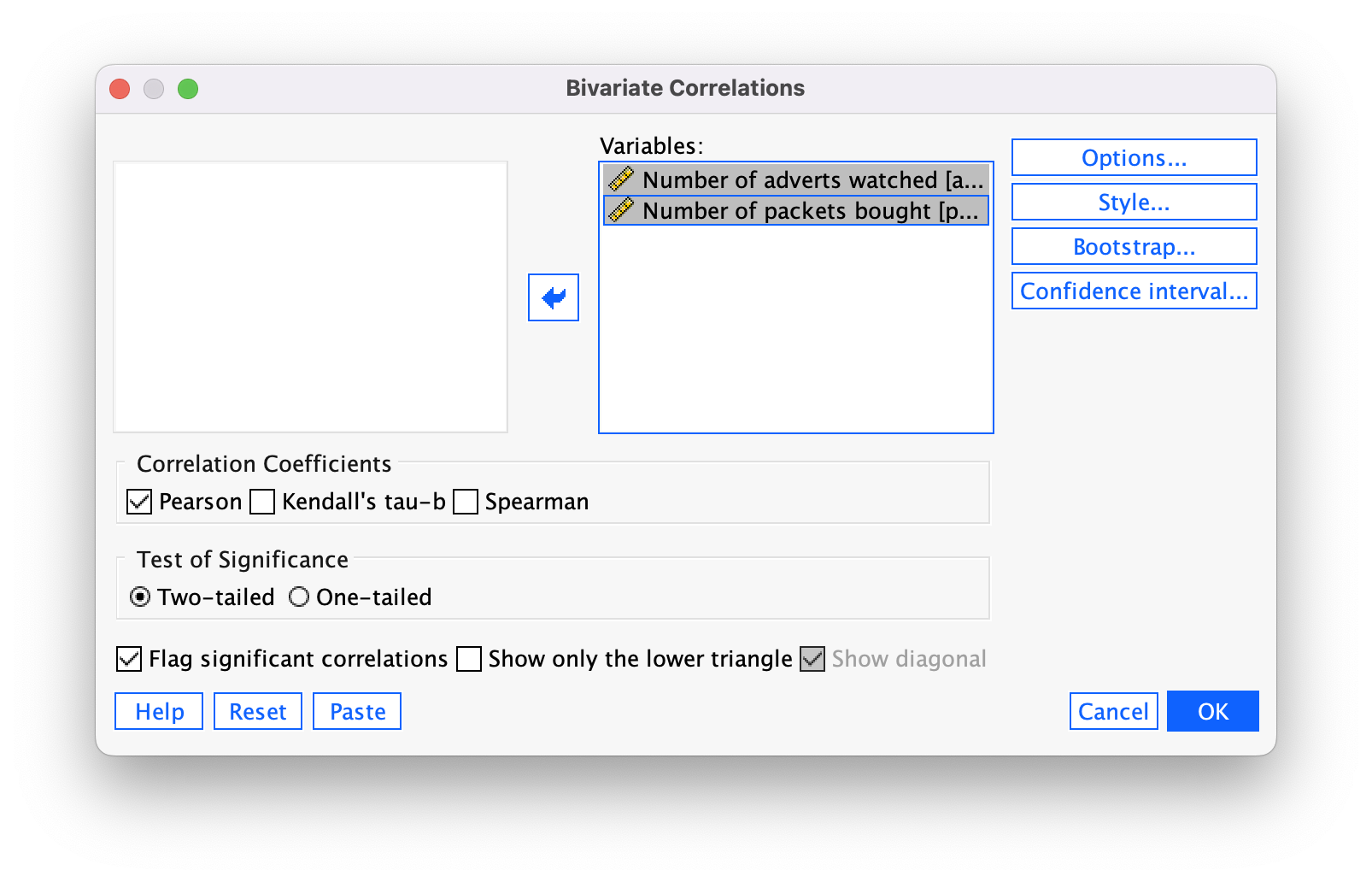

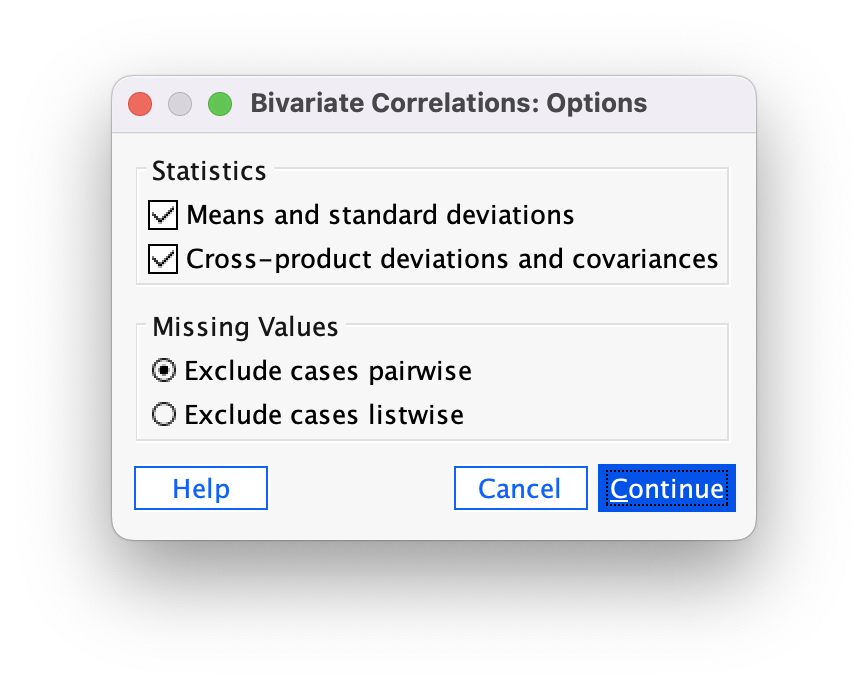

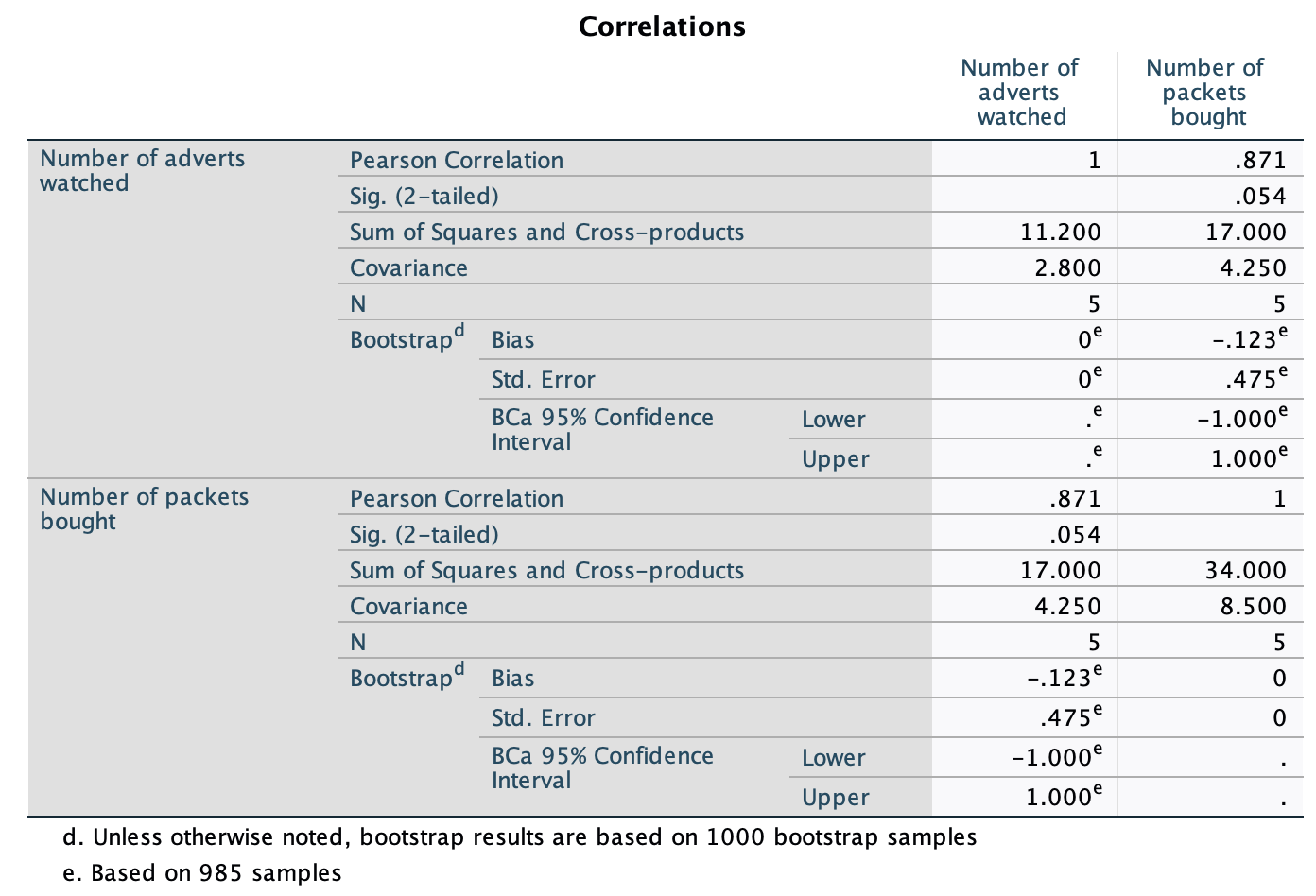

To illustrate what the extra options do, let’s run the data from the advert example in the chapter. First, enter the data as in Figure 8.4 in the chapter. Select Analyze > Correlate > Bivariate … to get the dialog box in Figure 34. Drag the variables Number of Adverts Watched [adverts] and Number of Packets Bought [packets] to the box labelled Variables:. Now click  and another dialog box appears with two Statistics options. Select them (Figure 35). Next click

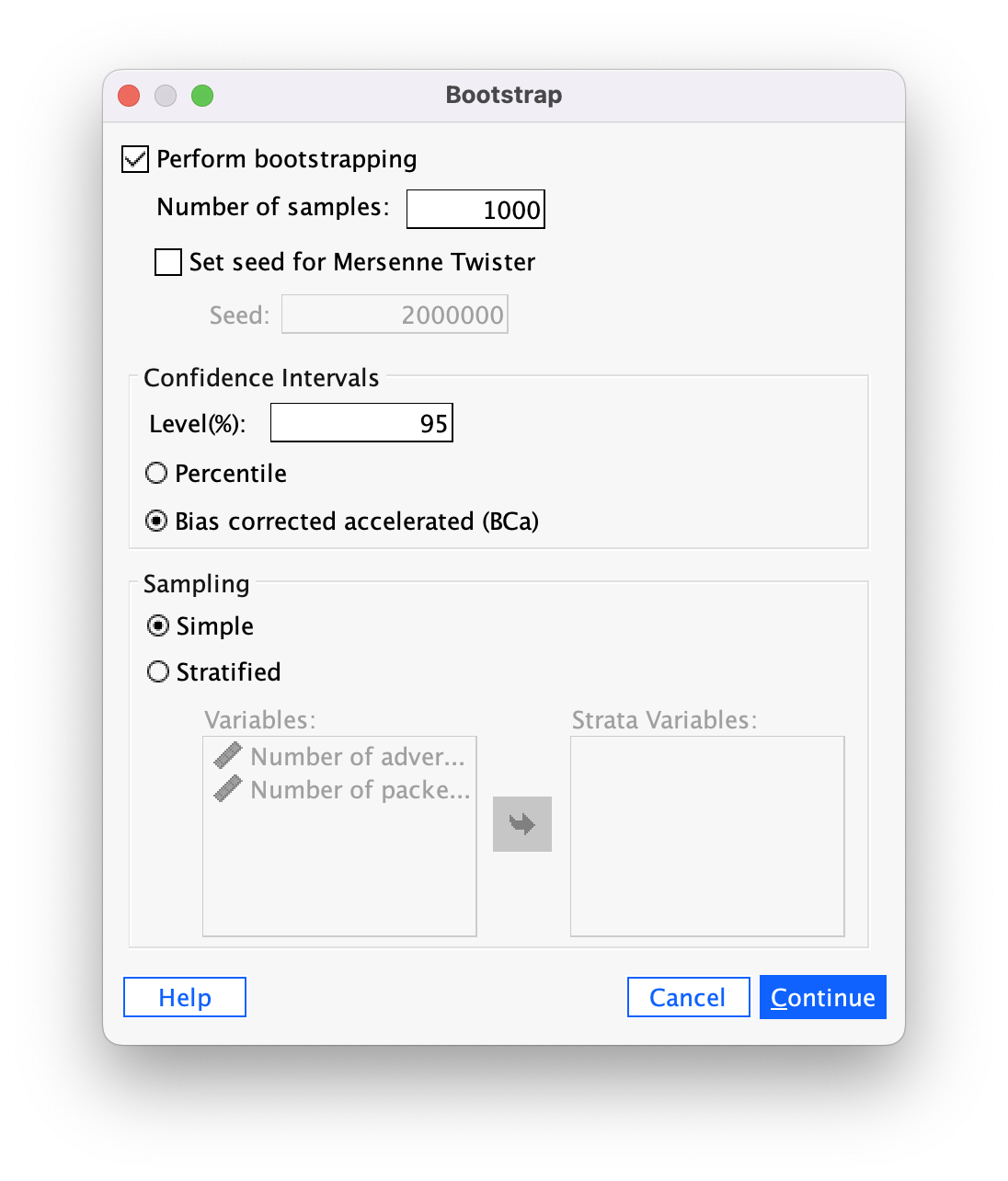

and another dialog box appears with two Statistics options. Select them (Figure 35). Next click  to get some robust confidence intervals (Figure 36).

to get some robust confidence intervals (Figure 36).

The resulting output is in Figure 37. The section labelled Sum of Squares and Cross-products shows us the cross-product (17 in this example) that we calculated in equation (8.6) in the chapter, and the sums of squares for each variable. The sums of squares are calculated from the top half of equation (8.4). The value of the covariance between the two variables is 4.25, which is the same value as was calculated from equation (8.6). The covariance within each variable is the same as the variance for each variable (so the variance for the number of adverts seen is 2.8, and the variance for the number of packets bought is 8.5). These variances can be calculated manually from equation (8.4).

Note that the Pearson correlation coefficient between the two variables is .871, which is the same as the value we calculated in the chapter. Underneath is the significance value of this coefficient (.054). We also have the BCa 95% confidence interval that ranges from −1.00 to 1.00. The fact that the confidence interval crosses zero (and the significance is greater than .05) tells us that there was not a significant relationship between the number of adverts watched and packets bought. It also suggests, assuming that this sample is one of the 95% that generates a confidence interval containing the population value, that the population value could be anything between a perfect negative correlation and a perfect positive one. In other words, literally any value is plausible.

Please, Sir, can I have some more … biserial correlation?

Imagine now that we wanted to convert the point-biserial correlation into the biserial correlation coefficient (\(r_b\)) (because some of the male cats were neutered and so there might be a continuum of maleness that underlies the gender variable). We must use this equation

\[ r_{b} = \frac{r_{\text{pb}}\sqrt{pq}}{y}. \]

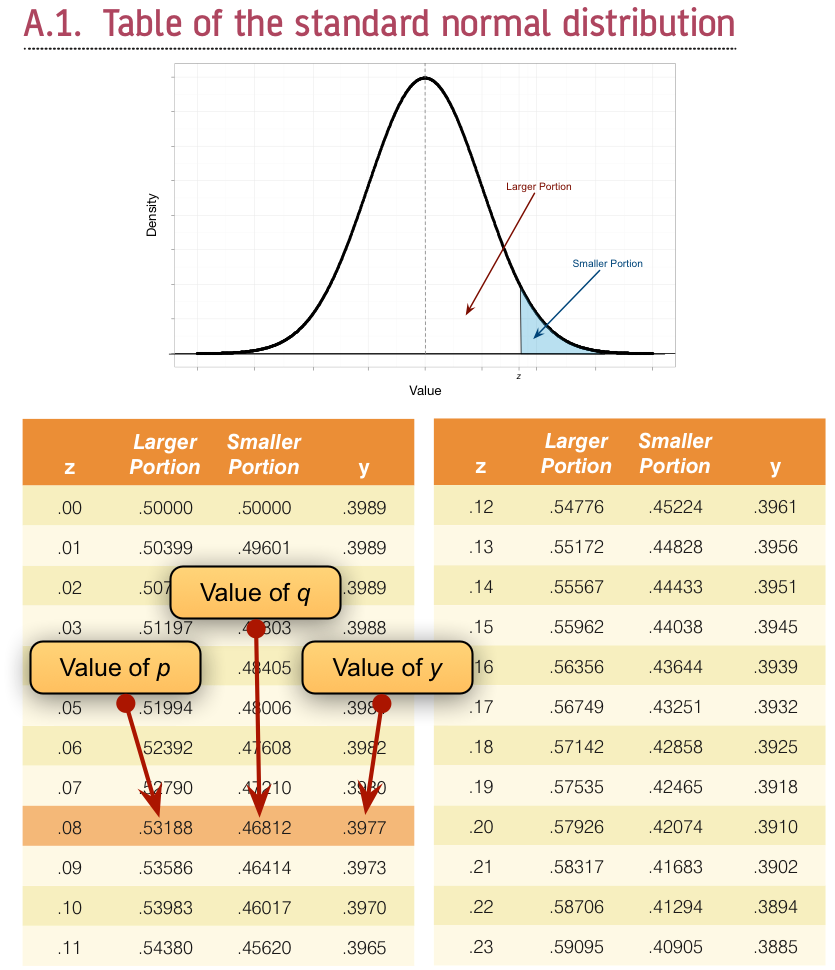

in which p is the proportion of cases that fell into the largest category and q is the proportion of cases that fell into the smallest category. Therefore, p and q are simply the number of male and female cats. In this equation, y is the ordinate of the normal distribution at the point where there is a proportion p of the area on one side and a proportion q on the other (this will become clearer as we do an example).

To calculate p and q, access the Frequencies dialog box using Analyze > Descriptive Statistics > Frequencies … and drag the variable sex to the box labelled Variable(s):. There is no need to click on any further options as the defaults will give you what you need to know (namely the percentage of male and female cats). It turns out that 53.3% (.533 as a proportion) of the sample was female (this is p, because it is the largest portion) while the remaining 46.7% (.467 as a proportion) were male (this is q because it is the smallest portion). To calculate y, we use these values and the values of the normal distribution displayed in the Appendix. The extract from the table shown in Figure 38 shows how to find y when the normal curve is split with .467 as the smaller portion and .533 as the larger portion. It shows which columns represent p and q, and we look for our values in these columns (the exact values of .533 and .467 are not in the table, so we use the nearest values that we can find, which are .5319 and .4681 respectively). The ordinate value is in the column y and is .3977.

If we replace these values in the equation above we get .475 (see below), which is quite a lot higher than the value of the point-biserial correlation (.378). This finding just shows you that whether you assume an underlying continuum or not can make a big difference to the size of effect that you get:

\[ \begin{align} r_b &= \frac{r_\text{pb}\sqrt{pq}}{y}\\ &= \frac{0.378\sqrt{0.533 \times 0.467}}{0.3977}\\ &= 0.475. \end{align} \]

If this process freaks you out, you can also convert the point-biserial r to the biserial r using a table published by (Terrell, 1982) in which you can use the value of the point-biserial correlation (i.e., Pearson’s r) and p, which is just the proportion of people in the largest group (in the above example, .533). This spares you the trouble of having to work out y in the above equation (which you’re also spared from using). Using Terrell’s table we get a value in this example of .48, which is the same as we calculated to 2 decimal places.

To get the significance of the biserial correlation we need to first work out its standard error. If we assume the null hypothesis (that the biserial correlation in the population is zero) then the standard error is given by (Terrell, 1982) as

\[ SE_{r_\text{b}} = \frac{\sqrt{pq}}{y\sqrt{N}}. \]

This equation is fairly straightforward because it uses the values of p, q and y that we already used to calculate the biserial r. The only additional value is the sample size (N), which in this example was 60. So, our standard error is

\[ \begin{align} SE_{r_\text{b}} &= \frac{\sqrt{0.533 \times 0.467}}{0.3977\sqrt{60}} \\ &= 0.162. \end{align} \]

The standard error helps us because we can create a z-score. To get a z-score we take the biserial correlation, subtract the mean in the population and divide by the standard error. We have assumed that the mean in the population is 0 (the null hypothesis), so we can simply divide the biserial correlation by its standard error

\[ \begin{align} z_{r_\text{b}} &= \frac{r_b - \overline{r}_b}{SE_{r_\text{b}}} \\ &= \frac{r_b - 0}{SE_{r_\text{b}}} \\ &= \frac{.475-0}{.162} \\ &= 2.93. \end{align} \]

We can look up this value of z (2.93) in the table for the normal distribution in the Appendix and get the one-tailed probability from the column labelled Smaller Portion. In this case the value is .00169. To get the two-tailed probability we multiply this value by 2, which gives us .00338.

Chapter 9

No Oliver Twisted in this chapter.

Chapter 10

No Oliver Twisted in this chapter.

Chapter 11

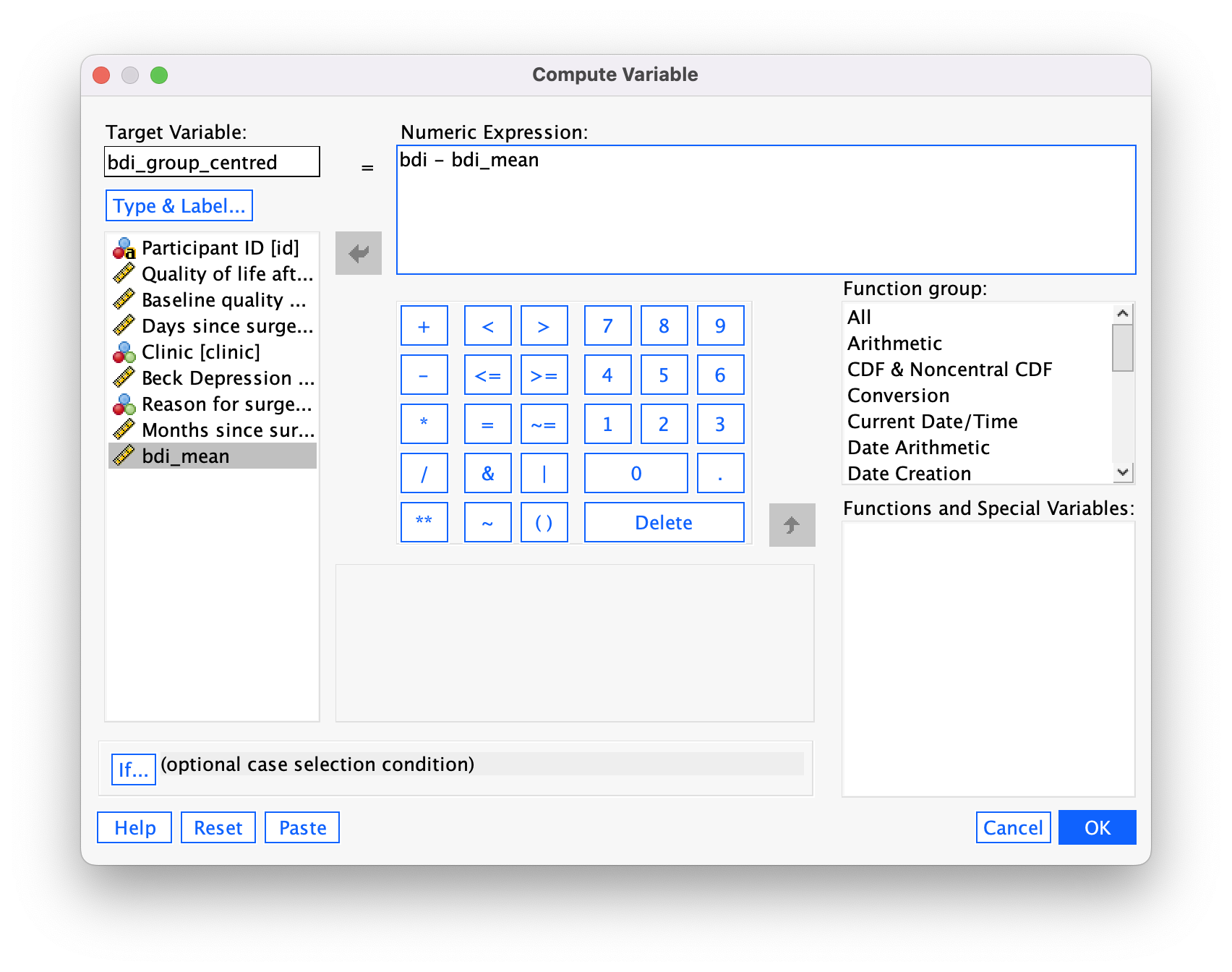

Please Sir, can I have some more … centring?

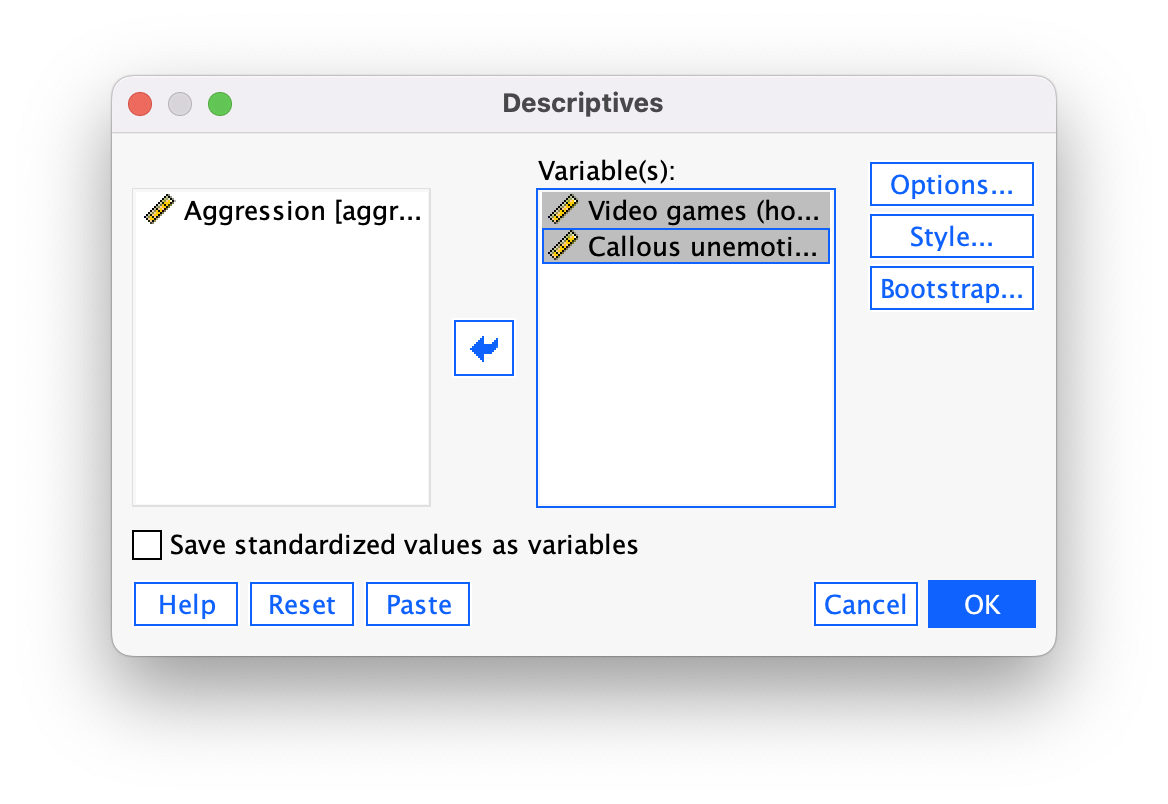

Grand mean centring is really easy: we can use the compute command that we encountered in the book. First, we need to find out the mean score for callous traits and gaming. We can do this using some simple descriptive statistics. Choose Analyze > Descriptive Statistics > Descriptives … to access the dialog box shown below. Drag vid_game and caunts to the box labelled Variable(s): (Figure 39).

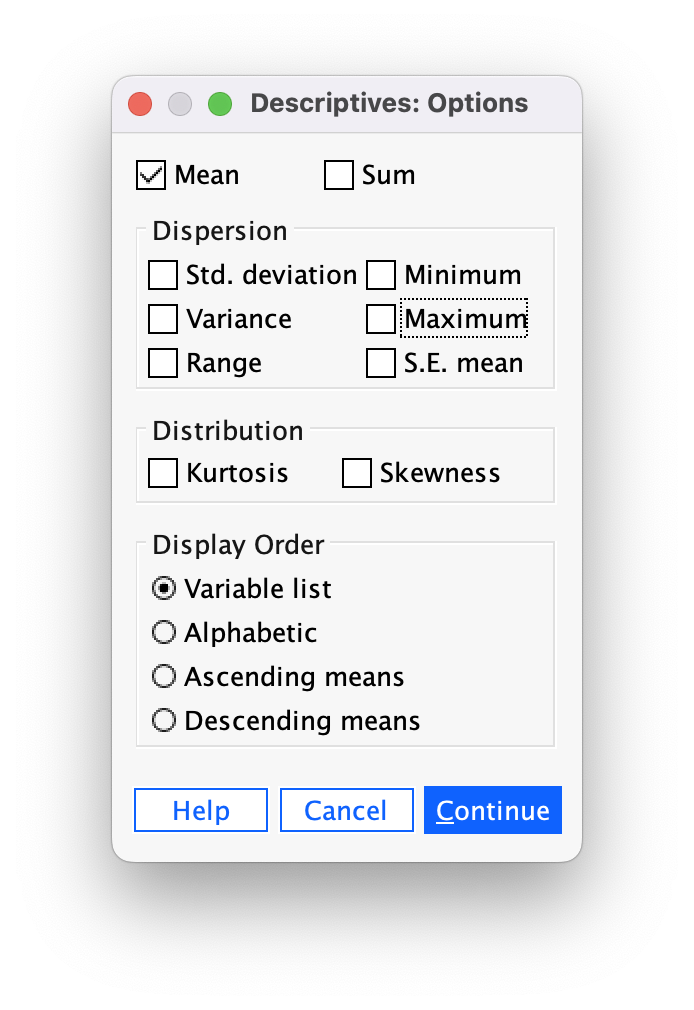

Next click  and select only the mean because we don’t need any other information (Figure 40).

and select only the mean because we don’t need any other information (Figure 40).

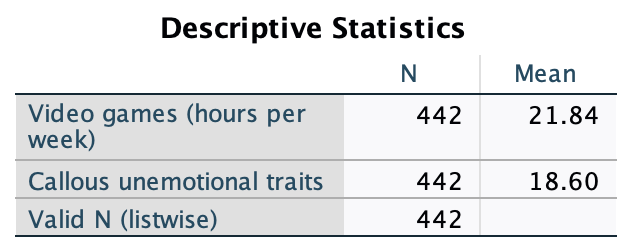

The resulting output (Figure 41) tells us that the mean for video game play was 21.84 hours per week, and for callous and unemotional traits was 18.60.

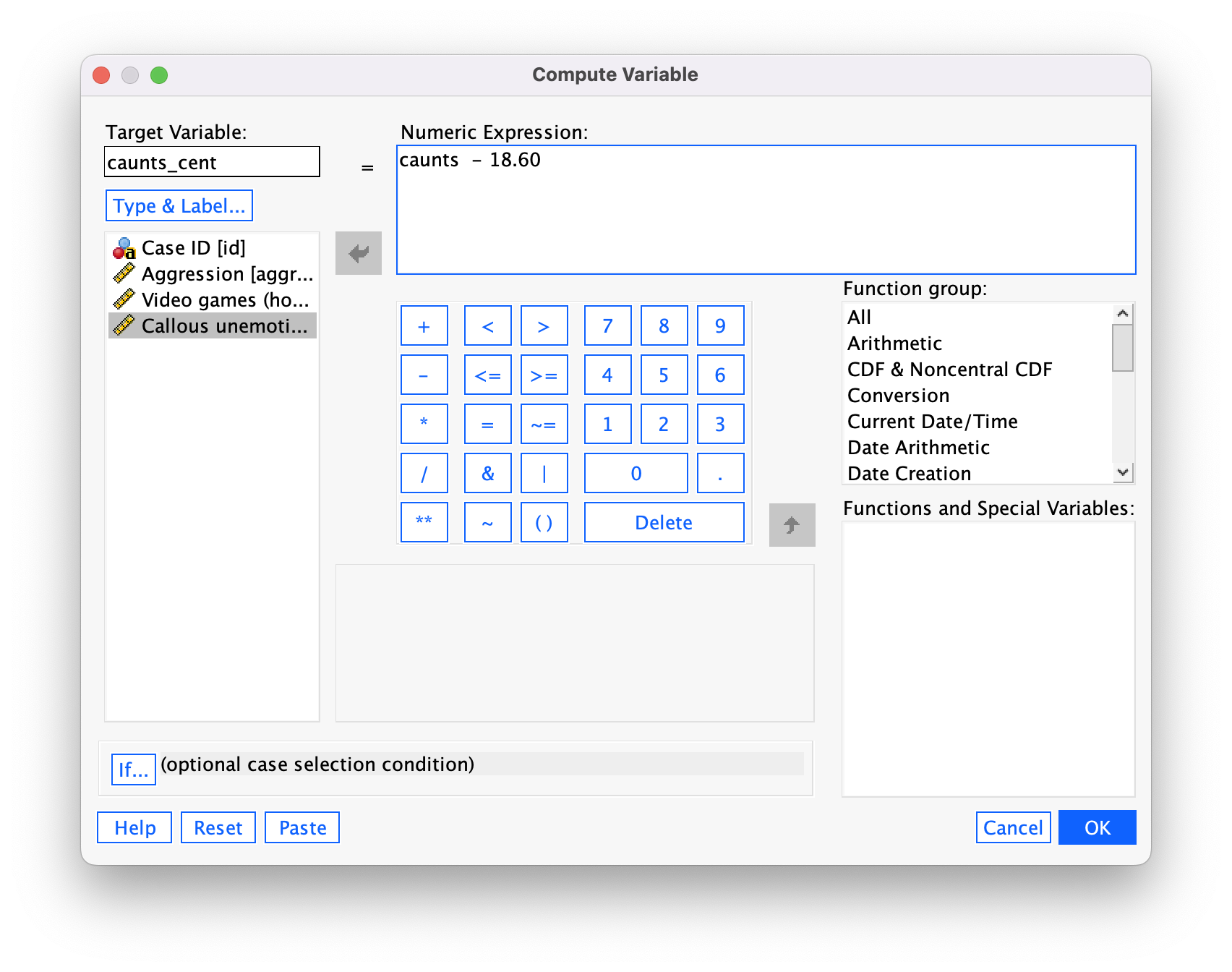

We use these value to centre the variable. Access the Compute command by selecting Transform > Compute Variable …. In the resulting dialog box enter the name caunts_cent into the box labelled Target Variable. Drag the variable caunts across to the area labelled Numeric Expression:, then type a minus sign (or click the button that looks like a minus sign) and type the value of the mean (18.60). The completed dialog box is in Figure 42.

Click  and a new variable will be created called

and a new variable will be created called caunts_cent, which is centred around the mean of the callous unemotional traits variable. The mean of this new variable should be approximately 0: run some descriptive statistics to see that this is true.

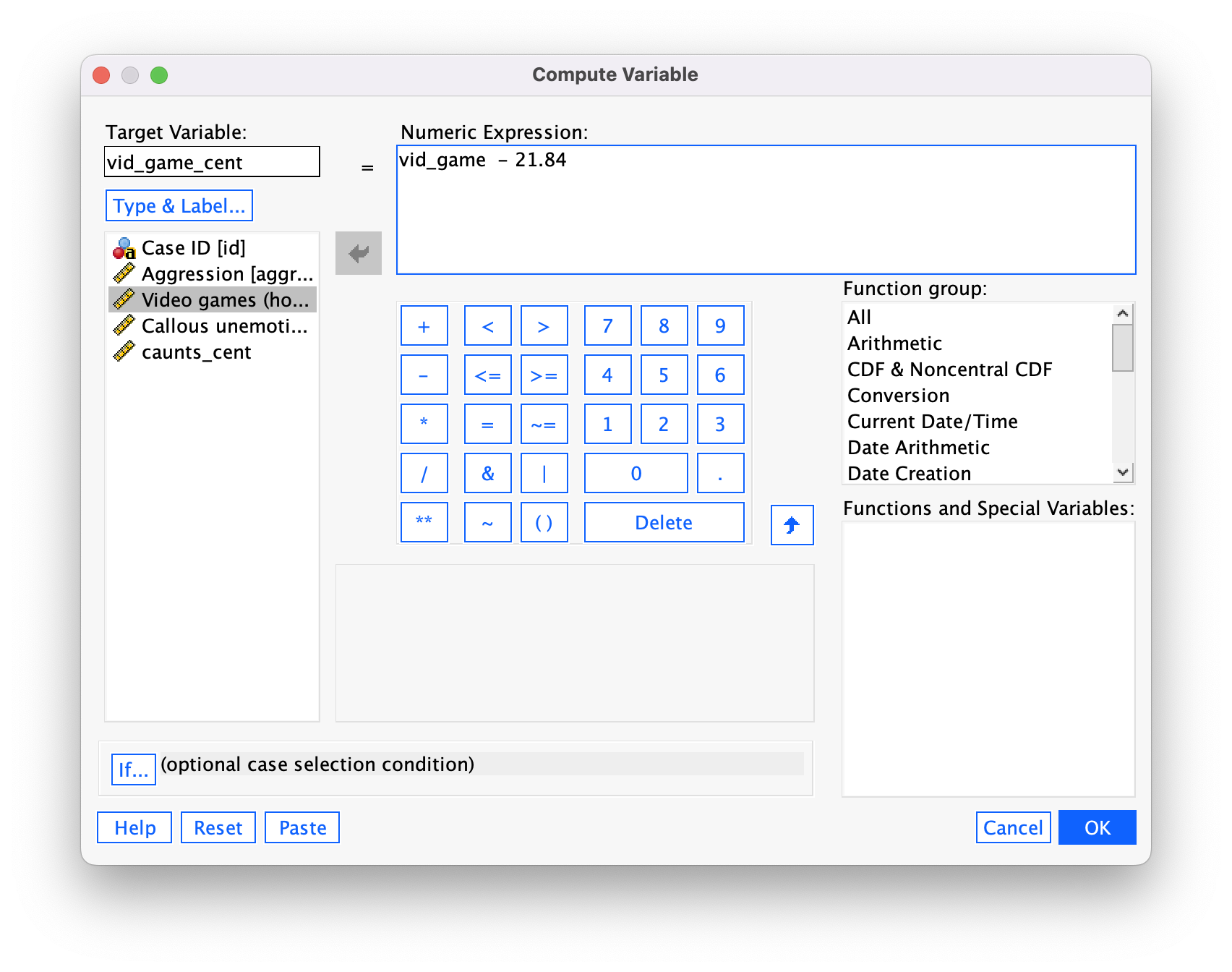

To centre the video game variable, we again select Transform > Compute Variable … but this time type the name vid_game_cent into the box labelled Target Variable. Drag the variable vid_game across to the area labelled Numric Expression, then type a minus sign (or click the button that looks like a minus sign) and type the value of the mean (21.84). The completed dialog box is in Figure 43.

Click  and a new variable will be created called

and a new variable will be created called vid_game_cent, which is centred around the mean of the number of hours spent playing video games. The mean of this new variable should be approximately 0.

You can centre both variables in a syntax window by executing:

COMPUTE caunts_cent = caunts −18.60.

COMPUTE vid_game_cent = vid_game−21.84.

EXECUTE.Chapter 12

Please, Sir, Can I have Some More … Welch’s F?

The (Welch, 1951) F-statistic is somewhat more complicated (hence why it’s stuck on the website). First we have to work out a weight that is based on the sample size, \(n_g\), and variance, \(s_g^2\), for a particular group

\[ w_g = \frac{n_g}{s_g^2}. \]

We also need to use a grand mean based on a weighted mean for each group. So we take the mean of each group, \({\overline{x}}_{g}\), and multiply it by its weight, \(w_g\), do this for each group and add them up, then divide this total by the sum of weights,

\[ \bar{x}_\text{Welch grand} = \frac{\sum{w_g\bar{x}_g}}{\sum{w_g}}. \]

The easiest way to demonstrate these calculations is using a table:

| Group | Variance (s2) | Sample size (\(n_g\)) | Weight (\(w_g\)) | Mean (\(\bar{x}_g\)) | Weight × Mean (\(w_g\bar{x}_g\)) |

|---|---|---|---|---|---|

| Control | 1.70 | 5 | 2.941 | 2.2 | 6.4702 |

| 15 Minutes | 1.70 | 5 | 2.941 | 3.2 | 9.4112 |

| 30 minutes | 2.50 | 5 | 2.000 | 5.0 | 10.000 |

| Σ = 7.882 | Σ = 25.8814 |

So we get

\[ \overline{x}_\text{Welch grand} = \frac{25.8814}{7.882} = 3.284. \]

Think back to equation 12.11 in the book, the model sum of squares was:

\[ \text{SS}_\text{M} = \sum_{g = 1}^{k}{n_g\big(\overline{x}_g - \overline{x}_\text{grand}\big)^2} \]

In Welch’s F this is adjusted to incorporate the weighting and the adjusted grand mean

\[ \text{SS}_\text{M Welch} = \sum_{n = 1}^{k}{w_g\big(\overline{x}_g - \overline{x}_\text{Welch grand}\big)^2}. \]

To create a mean square we divide by the degrees of freedom, \(k-1\),

\[ \text{MS}_\text{M Welch} = \frac{\sum{w_g\big(\bar{x}_g - \bar{x}_\text{Welch grand} \big)^2}}{k - 1}. \]

This gives us

\[ \text{MS}_\text{M Welch} = \frac{2.941( 2.2 - 3.284)^2 + 2.941( 3.2 - 3.284)^2 + 2(5 - 3.284)^2}{2}\ = 4.683 \]

We now have to work out a term called lambda, which is based again on the weights,

\[ \Lambda = \frac{3\sum\frac{\bigg(1 - \frac{w_g}{\sum{w_g}}\bigg)^2}{n_g - 1}}{k^2 - 1}. \]

This looks horrendous, but is based only on the sample size in each group, the weight for each group (and the sum of all weights), and the total number of groups, k. For the puppy data this gives us:

\[ \begin{align} \Lambda &= \frac{3\Bigg(\frac{\Big(1 - \frac{2.941}{7.882}\Big)^2}{5 - 1} + \frac{\Big( 1 - \frac{2.941}{7.882}\Big)^2}{5 - 1} + \frac{\Big( 1 - \frac{2}{7.882}\Big)^2}{5 - 1}\Bigg)}{3^2 - 1} \\ &= \frac{3(0.098 + 0.098 + 0.139)}{8} \\ &= 0.126 \end{align} \]

The F ratio is then given by:

\[ F_{W} = \frac{\text{MS}_\text{M Welch}}{1 + \frac{2\Lambda(k - 2)}{3}} \]

where k is the total number of groups. So, for the puppy therapy data we get:

\[ \begin{align} F_W &= \frac{4.683}{1 + \frac{(2 \times 0.126)(3 - 2)}{3}} \\ &= \frac{9.336}{1.084} \\ &= 4.32 \end{align} \]

As with the Brown–Forsythe F, the model degrees of freedom stay the same at \(k-1\) (in this case 2), but the residual degrees of freedom, \(df_R\), are \(\sfrac{1}{\Lambda}\) (in this case, 1/0.126 = 7.94).

Chapter 13

No Oliver Twisted in this chapter.

Chapter 14

Please, Sir, can I have some more … simple effects?

A simple main effect (usually called a simple effect) is the effect of one variable at levels of another variable. In the book we computed the simple effect of ratings of attractive and unattractive faces at each level of dose of alcohol (see the book for details of the example). Let’s look at how tp calculate these simple effects. In the book, we saw that the model sum of squares is calculated using:

\[ \text{SS}_\text{M} = \sum_{g = 1}^{k}{n_g\big(\bar{x}_g - \bar{x}_\text{grand}\big)^2} \]

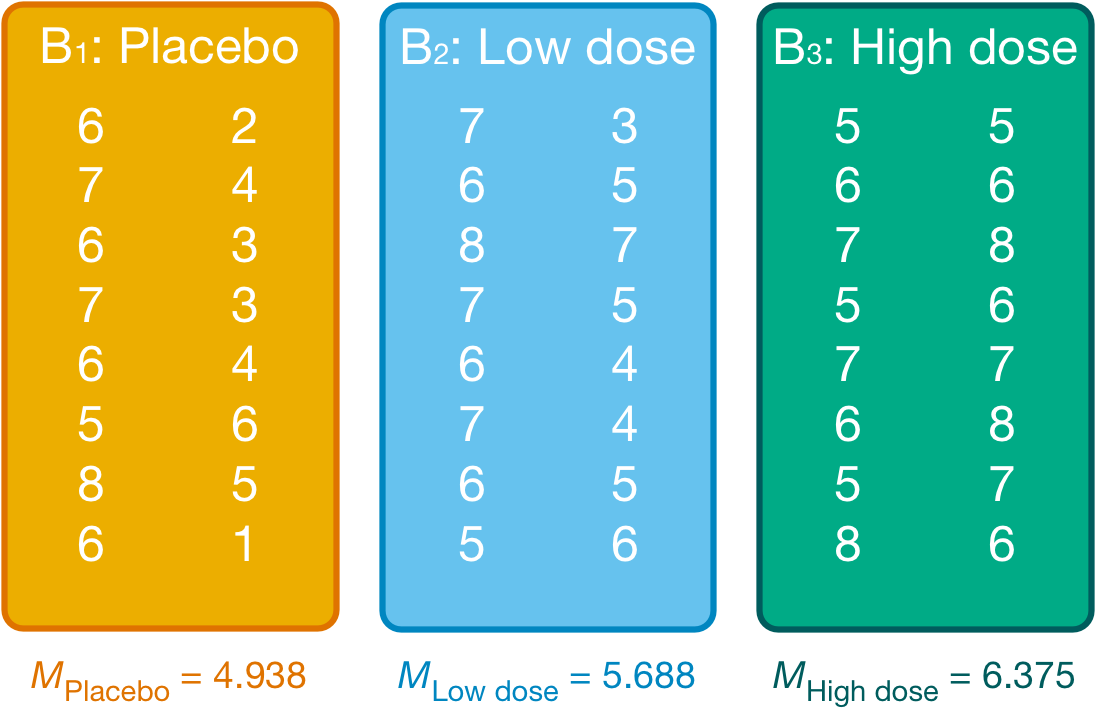

We group the data by the amount of alcohol drunk (the first column within each block are the scores for attractive faces and thes econd column the scores for unattractive faces):

Within each of these three groups, we calculate the overall mean (shown in the figure) and the mean rating of attractive and unattractive faces separately:

| Alcohol | Type of Face | Mean |

|---|---|---|

| Placebo | Unattractive | 3.500 |

| Placebo | Attractive | 6.375 |

| Low dose | Unattractive | 4.875 |

| Low dose | Attractive | 6.500 |

| High dose | Unattractive | 6.625 |

| High dose | Attractive | 6.125 |

For simple effects of face type at each level of alcohol we’d begin with the placebo and calculate the model sum of squares. The grand mean becomes the mean for all scores in the placebo group and the group means are the mean ratings of attractive and unattractive faces.

We can then apply the model sum of squares equation that we used for the overall model but using the grand mean of the placebo group (4.938) and the mean ratings of unattractive (3.500) and attractive (6.375) faces:

\[ \begin{align} \text{SS}_\text{Face, Placebo} &= \sum_{g = 1}^{k}{n_g\big(\bar{x}_g - \bar{x}_\text{grand}\big)^2} \\ &= 8(3.500 - 4.938)^2 + 8(6.375 - 4.938)^2 \\ &= 33.06 \end{align} \]

The degrees of freedom for this effect are calculated the same way as for any model sum of squares; they are one less than the number of conditions being compared (\(k-1\)), which in this case, where we’re comparing only two conditions, will be 1.

We do the same for the low-dose group. We use the grand mean of the low-dose group (5.688) and the mean ratings of unattractive and attractive faces,

\[ \begin{align} \text{SS}_\text{Face, Low dose} &= \sum_{g = 1}^{k}{n_g\big(\bar{x}_g - \bar{x}_\text{grand}\big)^2} \\ &= 8(4.875 - 5.688)^2 + 8(6.500 - 5.688)^2 \\ &= 10.56 \end{align} \]

The degrees of freedom are again \(k-1\) = 1.

Next, we do the same for the high-dose group. We use the grand mean of the high-dose group (6.375) and the mean ratings of unattractive and attractive faces,

\[ \begin{align} \text{SS}_\text{Face, High dose} &= \sum_{g = 1}^{k}{n_g\big(\bar{x}_g - \bar{x}_\text{grand}\big)^2} \\ &= 8(6.625 - 6.375)^2 + 8(6.125 - 6.375)^2 \\ &= 1. \end{align} \]

Again, the degrees of freedom are 1 (because we’ve compared two groups).

We need to convert these sums of squares to mean squares by dividing by the degrees of freedom but because all of these sums of squares have 1 degree of freedom, the mean squares are the same as the sum of squares. The final stage is to calculate an F-statistic for each simple effect by dividing the mean squares for the model by the residual mean squares. When conducting simple effects we use the residual mean squares for the original model (the residual mean squares for the entire model). In doing so we partition the model sums of squares and keep control of the Type I error rate. For these data, the residual sum of squares was 1.37 (see the book chapter). Therefore, we get:

\[ \begin{align} F_\text{FaceType, Placebo} &= \frac{\text{MS}_\text{Face, Placebo}}{\text{MS}_\text{R}} = \frac{33.06}{1.37} = 24.13 \\ F_\text{FaceType, Low dose} &= \frac{\text{MS}_\text{Face, Low dose}}{\text{MS}_\text{R}} = \frac{10.56}{1.37} = 7.71 \\ F_\text{FaceType, High dose} &= \frac{\text{MS}_\text{Face, High dose}}{\text{MS}_\text{R}} = \frac{1}{1.37} = 0.73 \end{align} \]

These values match those (approximately) in Output 14.6 (p. 681) in the book.

Please Sir, Can I … customize my model?

Different types of sums of squares

In the sister book on R (Field, 2025), I needed to explain sums of squares because, unlike IBM SPSS Statistics, R does not routinely use Type III sums of squares. Here’s an adaptation of what I wrote:

We can compute sums of squares in four different ways, which gives rise to what are known as Type I, II, III and IV sums of squares. To explain these, we need an example. Let’s use the example from the chapter: we’re predicting attractiveness from two predictors, facetype (attractive or unattractive facial stimuli) and alcohol (the dose of alcohol consumed) and their interaction (facetype × alcohol).

The simplest explanation of Type I sums of squares is that they are like doing a hierarchical regression in which we put one predictor into the model first, and then enter the second predictor. This second predictor will be evaluated after the first. If we entered a third predictor then this would be evaluated after the first and second, and so on. In other words the order that we enter the predictors matters. Therefore, if we entered our variables in the order facetype, alcohol and then facetype × alcohol, then alcohol would be evaluated after the effect of facetype and facetype × alcohol would be evaluated after the effects of both facetype and alcohol.

Type III sums of squares differ from Type I in that all effects are evaluated taking into consideration all other effects in the model (not just the ones entered before). This process is comparable to doing a forced entry regression including the covariate(s) and predictor(s) in the same block. Therefore, in our example, the effect of alcohol would be evaluated after the effects of both facetype and facetype × alcohol, the effect of facetype would be evaluated after the effects of both alcohol and facetype × alcohol, finally, facetype × alcohol would be evaluated afterthe effects of both alcohol and facetype.

Type II sums of squares are somewhere in between Type I and III in that all effects are evaluated taking into consideration all other effects in the model except for higher-order effects that include the effect being evaluated. In our example, this would mean that the effect of alcohol would be evaluated after the effect of facetype (note that unlike Type III sums of squares, the interaction term is not considered); similarly, the effect of facetype would be evaluated after only the effect of alcohol. Finally, because there is no higher-order interaction that includes facetype × alcohol this effect would be evaluated after the effects of both alcohol and facetype. In other words, for the highest-order term Type II and Type III sums of squares are the same. Type IV sums of squares are essentially the same as Type III but are designed for situations in which there are missing data.

The obvious question is which type of sums of squares should you use:

-

Type I: Unless the variables are completely independent of each other (which is unlikely to be the case) then Type I sums of squares cannot really evaluate the true main effect of each variable. For example, if we enter

facetypefirst, its sums of squares are computed ignoringalcohol; therefore any variance inattractivenessthat is shared byalcoholandfacetypewill be attributed tofacetype(i.e., variance that it shares withalcoholis attributed solely to it). The sums of squares foralcoholwill then be computed excluding any variance that has already been ‘given over’ tofacetype. As such the sums of squares won’t reflect the true effect ofalcoholbecause variance in attractiveness thatalcoholshares withfacetypeis not attributed to it because it has already been ‘assigned’ tofacetype. Consequently, Type I sums of squares tend not to be used to evaluate hypotheses about main effects and interactions because the order of predictors will affect the results. - Type II: If you’re interested in main effects then you should use Type II sums of squares. Unlike Type III sums of squares, Type IIs give you an accurate picture of a main effect because they are evaluated ignoring the effect of any interactions involving the main effect under consideration. Therefore, variance from a main effect is not ‘lost’ to any interaction terms containing that effect. If you are interested in main effects and do not predict an interaction between your main effects then these tests will be the most powerful. However, if an interaction is present, then Type II sums of squares cannot reasonably evaluate main effects (because variance from the interaction term is attributed to them). However, if there is an interaction then you shouldn’t really be interested in main effects anyway. One advantage of Type II sums of squares is that they are not affected by the type of contrast coding used to specify the predictor variables.

- Type III: Type III sums of squares tend to get used as the default in SPSS Statistics. They have the advantage over Type IIs in that when an interaction is present, the main effects associated with that interaction are still meaningful (because they are computed taking the interaction into account). Perversely, this advantage is a disadvantage too because it’s pretty silly to entertain ‘main effects’ as meaningful in the presence of an interaction. Type III sums of squares encourage people to do daft things like get excited about main effects that are superseded by a higher-order interaction. Type III sums of squares are preferable to other types when sample sizes are unequal; however, they work only when predictors are encoded with orthogonal contrasts.

Hopefully, it should be clear that the main choice in ANOVA designs is between Type II and Type III sums of squares. The choice depends on your hypotheses and which effects are important in your particular situation. If your main hypothesis is around the highest order interaction then it doesn’t matter which you choose (you’ll get the same results); if you don’t predict an interaction and are interested in main effects then Type II will be most powerful; and if you have an unbalanced design then use Type III. This advice is, of course, a simplified version of reality; be aware that there is (often heated) debate about which sums of squares are appropriate to a given situation.

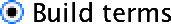

Customizing an ANOVA model

By default SPSS conducts a full factorial analysis (i.e., it includes all of the main effects and interactions of all independent variables specified in the main dialog box). However, there may be times when you want to customize the model that you use to test for certain things. To access the model dialog box, click  in the main dialog box. By default, the full factorial model is selected. Even with this selected, there is an option at the bottom to change the types of sums of squares that are used in the analysis

in the main dialog box. By default, the full factorial model is selected. Even with this selected, there is an option at the bottom to change the types of sums of squares that are used in the analysis  . We looked above at the differences between the various sums of squares. As already discussed, SPSS Statistics uses Type III sums of squares by default, which have the advantage that they are invariant to the cell frequencies. As such, they can be used with both balanced and unbalanced (i.e., different numbers of participants in different groups) designs. However, if you have any missing data in your design, you should change the sums of squares to Type IV (see above).

. We looked above at the differences between the various sums of squares. As already discussed, SPSS Statistics uses Type III sums of squares by default, which have the advantage that they are invariant to the cell frequencies. As such, they can be used with both balanced and unbalanced (i.e., different numbers of participants in different groups) designs. However, if you have any missing data in your design, you should change the sums of squares to Type IV (see above).

To customize a model, click  to activate the dialog box. The variables specified in the main dialog box will be listed on the left-hand side. You can select one, or several, variables from this list and transfer them to the box labelled Model: as either main effects or interactions. By default, SPSS transfers variables as interaction terms, but there are several options that allow you to enter main effects, or all two-way, three-way or four-way interactions. These options save you the trouble of having to select lots of combinations of variables (because, for example, you can select three variables, transfer them as all two-way interactions and it will create all three combinations of variables for you). Hence, you could select

to activate the dialog box. The variables specified in the main dialog box will be listed on the left-hand side. You can select one, or several, variables from this list and transfer them to the box labelled Model: as either main effects or interactions. By default, SPSS transfers variables as interaction terms, but there are several options that allow you to enter main effects, or all two-way, three-way or four-way interactions. These options save you the trouble of having to select lots of combinations of variables (because, for example, you can select three variables, transfer them as all two-way interactions and it will create all three combinations of variables for you). Hence, you could select facetype and alcohol (you can select both of them at the same time by holding down Ctrl or ⌘ on a Mac). Having selected them, click the drop-down menu and change it to  . Having done this, click on

. Having done this, click on  to move the main effects of

to move the main effects of facetype and alcohol to the box labelled Model:. Next, you could specify the interaction term. To do this, select facetype and alcohol simultaneously, then select  in the drop-down list and click on

in the drop-down list and click on  . This action moves the interaction of

. This action moves the interaction of facetype and alcohol to the box labelled Model:.

The finished dialog box should look like Figure 45.

Having specified whatever model you want to specify, click  to return to the main dialog box and then click

to return to the main dialog box and then click  to fit the model. Although model selection has important uses, it is likely that you’d want to run the full factorial analysis on most occasions and so wouldn’t customize your model.

to fit the model. Although model selection has important uses, it is likely that you’d want to run the full factorial analysis on most occasions and so wouldn’t customize your model.

Please Sir, can I have some more … contrasts?

In the book we looked at how to generate contrast codes. We used an example about puppy therapy and constructed the codes in Table 1.

In the example in the chapter that referred you here, we have a similar design on the variable alcohol in that there is a ‘no treatment’ control (the placebo drink) and then different doses of alcohol. This mimics the puppy therapy data where there was a no treatment control and then two ‘doses’ of puppy therapy (15 and 30 minutes). As such, we might be interested in using the same contrasts (Table 2). This also saves us thinking about new contrasts. The following table illustrates how these contrasts apply to the alcohol variable.

| Group | Dummy Variable 1 (Contrast 1) | Dummy Variable 2 (Contrast 2 ) | Product (Contrast 1 × Contrast 2) |

|---|---|---|---|

| Placebo | -2 | 0 | 0 |

| Low dose | 1 | -1 | -1 |

| High dose | 1 | 1 | 1 |

| Total | 0 | 0 | 0 |

Remember that contrast 1 compares the control group to the average of both alcohol groups. In other words, it compares the mean of the placebo group to the mean of the low- and high-dose groups combined. Contrast two then excludes the placebo group and compares the low dose group to the high dose group. These are basically the same contrasts as the Helmert contrasts explained in the chapter. Although we can specify Helmert contrasts through the dialog boxes, by specifying these contrasts manually it gives you a base to specify contrasts other than Helmert contrasts.

I explained in the book how you generate contrasts for a single predictor (see the chapter with puppy therapy example in). The complication when we have a factorial design is that we now have an interaction term the also involves this variable, so we need to specify contrast codes not just for the main effect but for the interaction also. For the example in the book we can specify a basic model with this syntax:

GLM Attractiveness BY facetype alcoholThis command tells SPSS to predict attractiveness from the variables facetype and alcohol. If we specify the predictors in this order then our interaction will be made up of the groups in the order in Table 3.

| Cell | IV1 (FaceType) | IV2 (Alcohol) | Cell mean |

|---|---|---|---|

| 1 | Unattractive | Placebo | Un_Placebo |

| 2 | Unattractive | Low dose | Un_Low |

| 3 | Unattractive | High dose | Un_High |

| 4 | Attractive | Placebo | Att_Placebo |

| 5 | Attractive | Low dose | Att_Low |

| 6 | Attractive | High dose | Att_High |

The next issue is that we need to specify a contrast for the interaction term as well as the main effect. We have to sort of ‘spread’ the contrast for the main effect of alcohol across the two levels of type of face. To do this we divide the contrast code by the number of levels in the second predictor. For example, there were two levels of type of face (attractive vs unattractive) so we divide each code for the main effect of alcohol by 2. This gives us the codes for the interaction in the bottom row of Table 4.

| Cell | IV1 (FaceType) | IV2 (Alcohol) | Main effect contrast code | Cell mean | Interaction contrast code |

|---|---|---|---|---|---|

| 1 | Unattractive | Placebo | 2 | Un_Placebo | 1.0 |

| 2 | Unattractive | Low dose | -1 | Un_Low | -0.5 |

| 3 | Unattractive | High dose | -1 | Un_High | -0.5 |

| 4 | Attractive | Placebo | 2 | Att_Placebo | 1.0 |

| 5 | Attractive | Low dose | -1 | Att_Low | -0.5 |

| 6 | Attractive | High dose | -1 | Att_High | -0.5 |

We do the same for the second contrast as illustrated in Table 5 (note the contrast for the interaction is made up of the codes for the main effect of alcohol divided by the number of levels of facetype).

| Cell | IV1 (FaceType) | IV2 (Alcohol) | Main effect contrast code | Cell mean | Interaction contrast code |

|---|---|---|---|---|---|

| 1 | Unattractive | Placebo | 0 | Un_Placebo | 0.0 |

| 2 | Unattractive | Low dose | 1 | Un_Low | 0.5 |

| 3 | Unattractive | High dose | -1 | Un_High | -0.5 |

| 4 | Attractive | Placebo | 0 | Att_Placebo | 0.0 |

| 5 | Attractive | Low dose | 1 | Att_Low | 0.5 |

| 6 | Attractive | High dose | -1 | Att_High | -0.5 |

The order of variables in the model matters, let’s just quickly look at why. We can specify the predictor variables the other way around to how we did above:

{r GLM Attractiveness BY Alcohol FaceType

(Notice that the order of facetype and alcohol has swapped compared to above). This command tells SPSS to predict attractiveness form the variables alcohol and facetype. If we specify the predictors in this order then our interaction will be made up of the groups in the order in Table 6 (compare to Table 3).

| Cell | IV1 (Alcohol) | IV2 (FaceType) | Cell mean |

|---|---|---|---|

| 1 | Placebo | Unattractive | Un_Placebo |

| 2 | Placebo | Attractive | Att_Placebo |

| 3 | Low dose | Unattractive | Un_Low |

| 4 | Low dose | Attractive | Att_Low |

| 5 | High dose | Unattractive | Un_High |

| 6 | High dose | Attractive | Att_High |

The resulting contrast codes (Table 7 and @Table 8) have the same value but need to be placed in a different order because the order of groups has changed (compare the bottom row of Table 7 and @Table 8 with the earlier Table 4 and @Table 5). The take home message is that you need to pay attention to the order in which you specify the predictors.

| Cell | IV1 (Alcohol) | IV2 (FaceType) | Main effect contrast code | Cell mean | Interaction contrast code |

|---|---|---|---|---|---|

| 1 | Placebo | Unattractive | 2 | Un_Placebo | 1.0 |

| 2 | Placebo | Attractive | 2 | Att_Placebo | 1.0 |

| 3 | Low dose | Unattractive | -1 | Un_Low | -0.5 |

| 4 | Low dose | Attractive | -1 | Att_Low | -0.5 |

| 5 | High dose | Unattractive | -1 | Un_High | -0.5 |

| 6 | High dose | Attractive | -1 | Att_High | -0.5 |

| Cell | IV1 (Alcohol) | IV2 (FaceType) | Cell mean | Main effect contrast code | Interaction contrast code |

|---|---|---|---|---|---|

| 1 | Placebo | Unattractive | Un_Placebo | 0 | 0.0 |

| 2 | Placebo | Attractive | Att_Placebo | 0 | 0.0 |

| 3 | Low dose | Unattractive | Un_Low | 1 | 0.5 |

| 4 | Low dose | Attractive | Att_Low | 1 | 0.5 |

| 5 | High dose | Unattractive | Un_High | -1 | -0.5 |

| 6 | High dose | Attractive | Att_High | -1 | -0.5 |

Having fathomed out the contrasts you want we need to specify them. You can do that with the syntax in the file goggles_contrasts.spwb which looks like this:

GLM attractiveness BY facetype alcohol

/PRINT TEST(LMATRIX)

/LMATRIX "Alcohol_Contrasts"

alcohol 2 -1 -1

facetype*alcohol 1 -1/2 -1/2 1 -1/2 -1/2;

alcohol 0 1 -1

facetype*alcohol 0 0.5 -0.5 0 0.5 -0.5.Let’s run through this line by line:

GLM attractiveness BY facetype alcoholThe above line specifies the model.

/PRINT TEST(LMATRIX)This line is optional, it just prints the tables of contrasts (useful for checking what you have specified).

/LMATRIX "Alcohol_Contrasts"This line is where we start to specify the contrasts. The stuff in “” is just a name, it can anything you like and you don’t have to specify a name at all if you won’t want to.

alcohol 2 -1 -1

facetype*alcohol 1 -1/2 -1/2 1 -1/2 -1/2;These two lines specify the first contrast by listing the codes for the main effect of alcohol, and then the interaction. A few things to note ‘alcohol’ must match the variable name in the original GLM command as do the variable names in ’facetype*alcohol’. If they don’t match then SPSS won’t know what variables you’re referring to. After the variable name (or interaction name) you type the codes. For the main effect of alcohol there are 6 (one for each combination of face type and alcohol). Note the codes for the interaction match the values in Table 4. Note that there is a semi-colon at the end, which tells SPSS to expect another contrast to be defined underneath.

alcohol 0 1 -1

facetype*alcohol 0 0.5 -0.5 0 0.5 -0.5.These two lines specify the second contrast by listing the codes for the main effect of alcohol, and then the interaction. As above the variable (or interaction name) you type the codes as we did for the first contrast. Note the codes are those from Table 5.

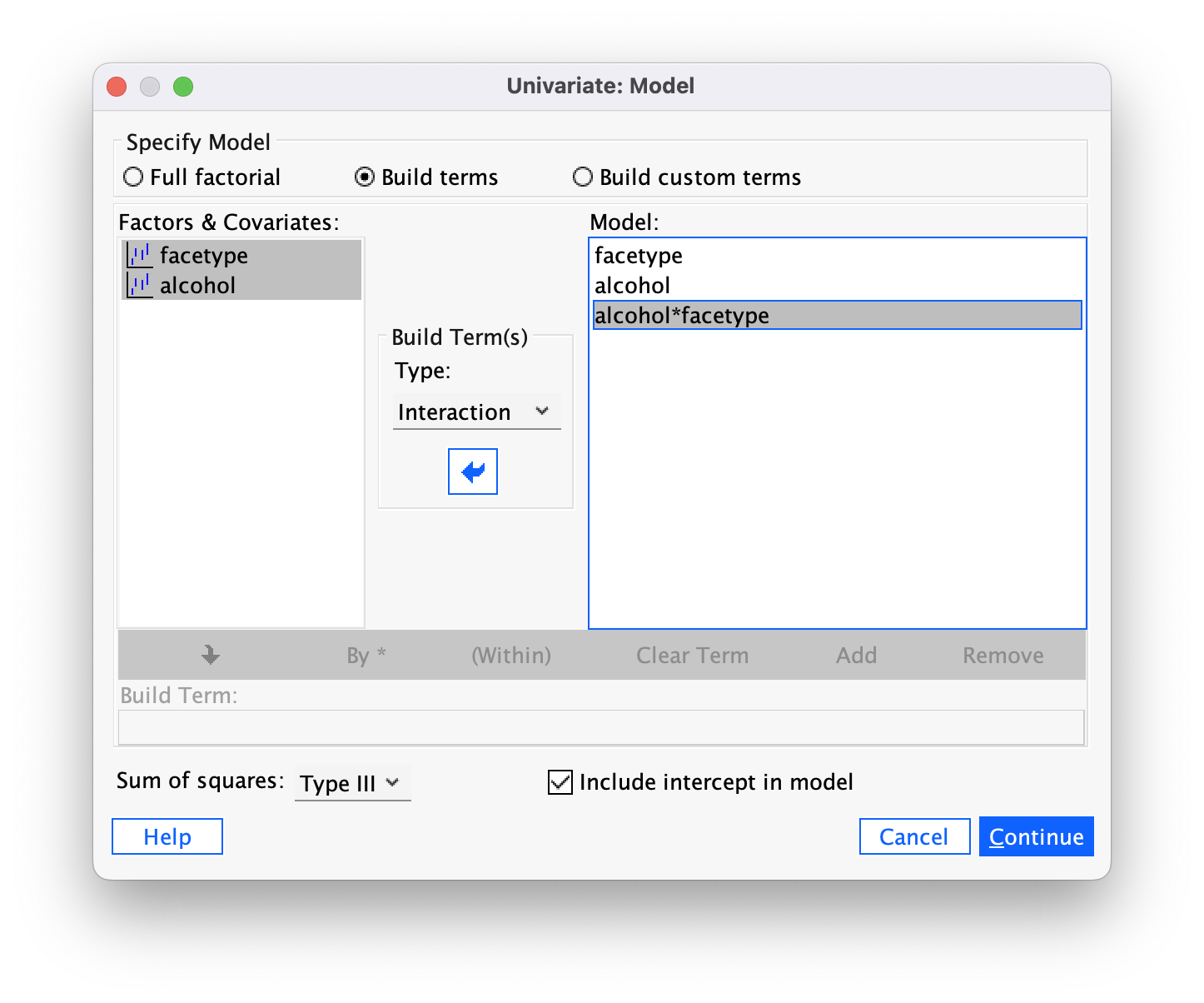

The output (Figure 46) shows the resulting contrasts. Note that the p-values match those from the Helmert contrast in the book (because that is what we specified). The contrast values do not match but this is simply because there are different values you can use to specify the same contrast, and these affect the value of the contrast itself but the contrast estimates will be a function of each other (for example, our first contrast estimate is −2.188 which is 2 × −1.094 (the value of the Helmert contrast).

Chapter 15

Please, Sir, can I have some more … sphericity?

Field, A. P. (1998). A bluffer’s guide to sphericity. Newsletter of the Mathematical, Statistical and Computing Section of the British Psychological Society, 6, 13–22.

Chapter 16

No Oliver Twisted in this chapter.

Chapter 17

Please, Sir, can I have some more … maths?

Calculation of E−1

\[ E = \begin{bmatrix} 51 & 13 \\ 13 & 122 \\ \end{bmatrix} \]

\[ \text{determinant of }E, |E| = (51 \times 122) - (13 \times 13) = 6053 \]

\[ \text{matrix of minors for }E = \begin{bmatrix} 122 & 13 \\ 13 & 51 \\ \end{bmatrix} \]

\[ \text{pattern of signs for 2 × 2 matrix} = \begin{bmatrix} + & - \\ - & + \\ \end{bmatrix} \]

\[ \text{matrix of cofactors} = \begin{bmatrix} 122 & -13 \\ -13 & 51 \\ \end{bmatrix} \]

The inverse of a matrix is obtained by dividing the matrix of cofactors for E by |E|, the determinant of E:

\[ E^{-1} = \begin{bmatrix} \frac{122}{6053} & \frac{- 13}{6053} \\ \frac{- 13}{6053} & \frac{51}{6053} \\ \end{bmatrix} = \begin{bmatrix} 0.0202 & -0.0021 \\ -0.0021 & 0.0084 \\ \end{bmatrix} \]

Calculation of HE−1

\[ \begin{align} HE^{-1} &= \begin{bmatrix} 10.47 & -7.53 \\ -7.53 & 19.47 \\ \end{bmatrix}\begin{bmatrix} 0.0202 & -0.0021 \\ -0.0021 & 0.0084 \\ \end{bmatrix} \\ &= \begin{bmatrix} (10.47 \times 0.0202) + (-7.53 \times -0.0021) & (10.47 \times - 0.0) + (-7.53\ \times 0.0084) \\ (-7.53 \times 0.0202) + (19.47 \times -0.0021) & (-7.53\ \times -0.0 ) + (19.47 \times 0.0084) \\ \end{bmatrix}\\ &= \begin{bmatrix} 0.2273 & - 0.0852 \\ -0.1903 & 0.1794 \\ \end{bmatrix} \end{align} \]

Calculation of eigenvalues

The eigenvalues or roots of any square matrix are the solutions to the determinantal equation |A − λI| = 0, in which A is the square matrix in question and I is an identity matrix of the same size as A. The number of eigenvalues will equal the number of rows (or columns) of the square matrix. In this case the square matrix of interest is HE−1:

\[ \begin{align} |\text{HE}^{-1} - \lambda I| &= \left| \begin{pmatrix} 0.2273 & - 0.0852 \\ -0.1903 & 0.1794 \\ \end{pmatrix}\begin{pmatrix} \lambda & 0 \\ 0 & \lambda \\ \end{pmatrix} \right|\\ &= \left| \begin{pmatrix} 0.2273-\lambda & -0.0852 \\ -0.1903 & 0.1794-\lambda \\ \end{pmatrix} \right|\\ &= (0.2273 - \lambda)(0.1794 - \lambda) - (-0.1930 \times -0.0852) \\ &= \lambda^2 - 0.2273\lambda - 0.1794\lambda + 0.0407 - 0.0164\\ &= \lambda^2 - 0.4067\lambda + 0.0243 \end{align} \]

Therefore the equation |HE−1 − λI| = 0 can be expressed as:

\[ \lambda^2 - 0.4067\lambda + 0.0243 = 0 \]

To solve the roots of any quadratic equation of the general form\(a\lambda^2 + b\lambda + c = 0\) we can apply the following formula:

\[ \lambda_i = \frac{-b \pm \sqrt{(b^2 - 4ac)}}{2a} \]

For the quadratic equation obtained, a = 1, b = −0.4067, c =0.0243. If we replace these values into the formula for discovering roots, we get:

\[ \begin{align} \lambda_i &= \frac{-b \pm \sqrt{(b^2 - 4ac)}}{2a}\\ &= \frac{0.4067 \pm \sqrt{-0.4067^2 - 0.0972}}{2}\\ &= \frac{0.4067 + 0.2612}{2} & \frac{0.4067 - 0.2612}{2}\\ &= \frac{0.6679}{2} & \frac{0.1455}{2}\\ &= 0.334\ &\ 0.073 \end{align} \]

Hence, the eigenvalues are 0.334 and 0.073.

Chapter 18

Please Sir, can I have some more … matrix algebra?

Calculation of factor score coefficients

The matrix of factor score coefficients (B) and the inverse of the correlation matrix (R−1) for the popularity data are shown below. The matrices R−1 and A can be multiplied by hand to get the matrix B. To get the same degree of accuracy as SPSS Statistics you should work to at least 5 decimal places:

\[ \begin{align} B &= R^{- 1}A \\ &= \begin{pmatrix} 4.76 & -7.46 & 3.91 & -2.35 & 2.42 & -0.49 \\ -7.46 & 18.49 & -12.42 & 5.45 & -5.54 & 1.22 \\ 3.91 & -12.42 & 10.07 & - 3.65 & 3.79 & -0.96 \\ -2.35 & 5.45 & -3.65 & 2.97 & -2.16 & 0.02 \\ 2.42 & -5.54 & 3.79 & - 2.16 & 2.98 & -0.56 \\ -0.49 & 1.22 & -0.96 & 0.02 & -0.56 & 1.27 \\ \end{pmatrix}\begin{pmatrix} 0.87 & 0.01 \\ 0.96 & -0.03 \\ 0.92 & 0.04 \\ 0.00 & 0.82 \\ -0.10 & 0.75 \\ 0.09 & 0.70 \\ \end{pmatrix}\\ &=\begin{pmatrix} 0.343 & 0.006 \\ 0.376 & -0.020 \\ 0.362 & 0.020 \\ 0.000 & 0.473 \\ -0.037 & 0.437 \\ 0.039 & 0.405 \\ \end{pmatrix} \end{align} \]

Column 1 of matrix B

To get the first element of the first column of matrix B, you need to multiply each element in the first column of matrix A with the correspondingly placed element in the first row of matrix R−1. Add these six products together to get the final value of the first element. To get the second element of the first column of matrix B, you need to multiply each element in the first column of matrix A with the correspondingly placed element in the second row of matrix R−1. Add these six products together to get the final value … and so on:

\[ \begin{align} B_{11} &= (4.76 \times 0.87) + (-7.46 \times 0.96) + (3.91 \times 0.92 ) + (-2.35 \times -0.00) + (2.42 \times -0.10) + (-0.49 \times 0.09)\\ &= 0.343\\ B_{21} &= (-7.46 \times 0.87) + \ (18.49 \times 0.96) + (-12.42 \times 0.92) + (5.45 \times -0.00) + (-5.54 \times -0.10) + ( 1.22 \times 0.09)\\ &= 0.376\\ B_{31} &= (3.91 \times 0.87) + (-12.42 \times 0.96) + (10.07 \times 0.92) + (-3.65 \times -0.00) + (3.70 \times - 0.10 ) + (-0.96 \times 0.09 )\\ &= 0.362\\ B_{41} &= (-2.35 \times 0.87) + ( 5.45\ \times 0.96) + (-3.65 \times 0.92 ) + ( 2.97 \times -0.00 ) + (-2.16 \times -0.10 ) + (0.02\ \times \ 0.09)\\ &= 0.000\\ B_{51} &= (2.42 \times 0.87) + (-5.54\ \times 0.96) + (3.79 \times 0.92 ) + (-2.16 \times -0.00 ) + (2.98 \times -0.10 ) + (- 0.56\ \times 0.09)\\ &= -0.037\\ B_{61} &= (-0.49 \times 0.87) + (1.22 \times 0.96) + (-0.96 \times 0.92 ) + ( 0.02 \times -0.00) + (-0.56 \times -0.10 ) + (1.27 \times 0.09)\\ &= 0.039 \end{align} \]

Column 2 of matrix B

To get the first element of the second column of matrix B, you need to multiply each element in the second column of matrix A with the correspondingly placed element in the first row of matrix R−1. Add these six products together to get the final value. To get the second element of the second column of matrix B, you need to multiply each with the correspondingly placed element in the second row of matrix R−1. Add these six products together to get the final value … and so on:

\[ \begin{align} B_{12} &= (4.76 \times 0.01) + (-7.46 \times -0.03) + (3.91 \times 0.04) + (-2.35 \times 0.82) + (2.42 \times 0.75) + (-0.49 \times 0.70)\\ &= 0.006\\ B_{22} &= (-7.46 \times 0.01) + \ (18.49 \times -0.03) + (-12.42 \times0.04) + (5.45 \times 0.82) + (-5.54 \times 0.75) + (1.22 \times 0.70)\\ &=-0.020\\ B_{32} &= (3.91 \times 0.01) + (-12.42 \times -0.03) + (10.07 \times 0.04) + (-3.65 \times 0.82) + (3.70 \times 0.75) + (-0.96 \times 0.70)\\ &= 0.020\\ B_{42} &= (-2.35 \times 0.01) + ( 5.45\ \times -0.03) + (-3.65 \times 0.04) + ( 2.97 \times 0.82) + (-2.16 \times 0.75) + (0.02\ \times \ 0.70)\\ &= 0.473\\ B_{52} &= (2.42 \times 0.01) + (-5.54\ \times -0.03) + (3.79 \times 0.04) + (-2.16 \times 0.82) + (2.98 \times 0.75) + (- 0.56\ \times 0.70)\\ &= 0.473\\ B_{62} &= (-0.49 \times 0.01) + (1.22 \times -0.03) + (-0.96 \times 0.04) + ( 0.02 \times 0.82) + (-0.56 \times 0.75) + (1.27 \times 0.70)\\ &= 0.405 \end{align} \]

Factor scores

The pattern of the loadings is the same for the factor score coefficients: that is, the first three variables have high loadings for the first factor and low loadings for the second, whereas the pattern is reversed for the last three variables. The difference is only in the actual value of the weightings, which are smaller because the correlations between variables are now accounted for. These factor score used to replace the b-values in the equation for the factor:

\[ \begin{align} \text{Sociability}_i &= 0.343\text{Talk 1}_i + 0.376\text{Social skills}_i + 0.362\text{Interest}_i + 0.00\text{Talk 2}_i - 0.037\text{Selfish}_i + 0.039\text{Liar}_i\\ &= (0.343 \times 4) + (0.376 \times 9) + (0.362 \times 8) + (0.00 \times 6) - (0.037\times 8) + (0.039\times 6)\\ &= 7.59\\ \text{Consideration}_i &= 0.006\text{Talk 1}_i - 0.020\text{Social skills}_i + 0.020\text{Interest}_i + 0.473\text{Talk 2}_i + 0.437\text{Selfish}_i + 0.405\text{Liar}_i\\ &= (0.006 \times 4) - (0.020 \times 9) + (0.020 \times 8) + (0.473 \times 6) + (0.437 \times 8) + (0.405 \times 6)\\ &= 8.768 \end{align} \]

In this case, we use the same participant scores on each variable as were used in the chapter. The resulting scores are much more similar than when the factor loadings were used as weights because the different variances among the six variables have now been controlled for. The fact that the values are very similar reflects the fact that this person not only scores highly on variables relating to sociability, but is also inconsiderate (i.e., they score equally highly on both factors).

Please, Sir, can I have some more … questionnaires?

As a rule of thumb, never to attempt to design a questionnaire! A questionnaire is very easy to design, but a good questionnaire is virtually impossible to design. The point is that it takes a long time to construct a questionnaire, with no guarantees that the end result will be of any use to anyone. A good questionnaire must have three things: discrimination, reliability and validity.

Discrimination

Discrimination is really an issue of item selection. Discrimination simply means that people with different scores on a questionnaire differ in the construct of interest to you. For example, a questionnaire measuring social phobia should discriminate between people with social phobia and people without it (i.e., people in the different groups should score differently). There are three corollaries to consider:

- People with the same score should be equal to each other along the measured construct.

- People with different scores should be different to each other along the measured construct.

- The degree of difference between people is proportional to the difference in scores.

This is all pretty self-evident really, so what’s the fuss about? Well, let’s take a really simple example of a three-item questionnaire measuring sociability. Imagine we administered this questionnaire to two people: Jane and Katie. Their responses are shown below.

Jane responded yes to items 1 and 3 but no to item 2. If we score a yes with the value 1 and a no with a 0, then we can calculate a total score of 2. Katie, on the other hand, answers yes to items 1 and 2 but no to item 3. Using the same scoring system her score is also 2. Therefore, numerically you have identical answers (i.e. both Jane and Katie score 2 on this questionnaire); therefore, these two people should be comparable in their sociability — are they?

The answer is: not necessarily. It seems that Katie likes to go to parties and the pub but doesn’t enjoy meeting people in general, whereas Jane enjoys parties and meeting people but doesn’t enjoy the pub. It seems that Katie likes social situations involving alcohol (e.g. the pub and parties) but Jane likes socializing in general, but doesn’t like pubs — perhaps because there are more strangers there than at parties. In many ways, therefore, these people are very different because our questions are contaminated by other factors (i.e. attitudes to alcohol or different social environments). A good questionnaire should be designed such that people with identical numerical scores are identical in the construct being measured — and that’s not as easy to achieve as you might think!

A second related point is score differences. Imagine you take scores on the Spider Phobia Questionnaire. Imagine you have three participants who do the questionnaire and get the following scores: Andy scores 30 on the SPQ (very spider phobic), Graham scores 15 (moderately phobic) and Dan scores 10 (not very phobic at all). Does this mean that Dan and Graham are more similar in their spider phobia than Graham and Andy? In theory this should be the case because Graham’s score is more similar to Dan’s (difference = 5) than it is to Andy’s (difference = 15). In addition, is it the case that Andy is three times more phobic of spiders than Dan is? Is he twice as phobic as Graham? Again, his scores suggest that he should be. The point is that you can’t guarantee in advance that differences in score are going to be comparable, yet a questionnaire needs to be constructed such that the difference in score is proportional to the difference between people.

Validity

Items on your questionnaire must measure something, and a good questionnaire measures what you designed it to measure (this is called validity). Validity basically means ‘measuring what you think you’re measuring’. So, an anxiety measure that actually measures assertiveness is not valid; however, a materialism scale that does actually measure materialism is valid. Validity is a difficult thing to assess and it can take several forms:

-

Content validity. Items on a questionnaire must relate to the construct being measured. For example, a questionnaire measuring intrusive thoughts is pretty useless if it contains items relating to statistical ability. Content validity is really how representative your questions are — the sampling adequacy of items. This is achieved when items are first selected: don’t include items that are blatantly very similar to other items, and ensure that questions cover the full range of the construct.

- Criterion validity. This is basically whether the questionnaire is measuring what it claims to measure. In an ideal world, you could assess this by relating scores on each item to real-world observations (e.g., comparing scores on sociability items with the number of times a person actually goes out to socialize). This is often impractical and so there are other techniques such as (a) using the questionnaire in a variety of situations and seeing how predictive it is; (b) seeing how well it correlates with other known measures of your construct (i.e., sociable people might be expected to score highly on extroversion scales); and (c) using statistical techniques such as the Item Validity Index.

- Factorial validity. This validity basically refers to whether the factor structure of the questionnaire makes intuitive sense. As such, factorial validity is assessed through factor analysis. When you have your final set of items you can conduct a factor analysison the data (see the book). Factor analysis takes your correlated questions and recodes them into uncorrelated, underlying variables called factors (an example might be recoding the variables height, chest size, shoulder width and weight into an underlying variable called ‘build’). As another example, to assess success in a course we might measure attentiveness in seminars, the amount of notes taken in seminars, and the number of questions asked during seminars — all of these variables may relate to an underlying trait such as ‘motivation to succeed’. Factor analysis produces a table of items and their correlation, or loading, with each factor. A factor is composed of items that correlate highly with it. Factorial validity can be seen from whether the items tied on to factors make intuitive sense or not. Basically, if your items cluster into meaningful groups then you can infer factorial validity.

Validity is a necessary but not sufficient condition of a questionnaire.

Reliability